Forex trading moves over $7.5 trillion every day, which makes it the largest financial market in the world. The numbers you see on trading screens represent the prices at which currencies are exchanged. Knowing how to read forex quotes correctly is essential for building any successful trading strategy.

Statistics show that between 72% and 85% of retail forex traders lose money. So what’s the real difference between those who succeed and those who don’t? One of the main reasons is a lack of understanding of forex quotes. Without knowing how to read them, you are effectively trading without a plan or clear direction.

Forex quotes display two prices: a bid and an ask. Think of them as price tags at a currency exchange, updated multiple times per second. Each currency pair has its own quote, and the difference between the bid and ask, called the spread, represents the cost of trading that pair.

This guide will teach you how to read forex quotes, starting from the basics and advancing to professional techniques traders use to identify opportunities and manage risk effectively.

What are Forex Quotes: Let’s Discuss in Detail

What are Currency Pairs in Forex?

Forex can be confusing for newcomers because every trade involves two currencies, not just one. When you buy euros, you are simultaneously selling another currency to pay for them, usually dollars. That is why all forex quotes appear as currency pairs rather than individual currencies.

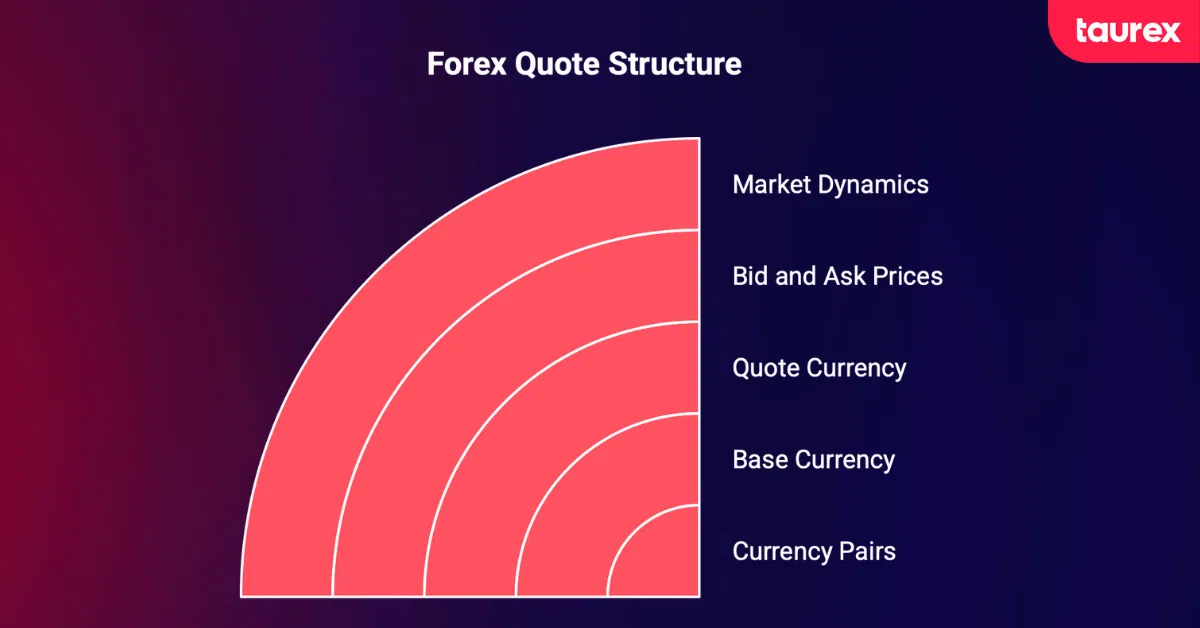

The standard format looks like EUR/USD or GBP/JPY. The first currency, called the base currency, is what you are buying or selling. The second, called the quote currency, is what you use to pay for it.

For example, when EUR/USD is quoted at 1.1700, it means that one euro costs $1.17. The quote answers a simple question: how much of the second currency do you need to buy one unit of the first?

TradeTaurex clearly displays currency pairs with bid and ask prices, making it easy for traders to see exactly what they will pay or receive. This is a must-step for anyone who wants to learn how to read forex quotes.

What is the Structure of Forex Quotes?

Forex quotes follow a predictable structure, even if they seem complex at first. Take EUR/USD 1.1700/1.1703. These numbers represent the two sides of every trade: the bid price, which is the price at which you can sell, and the ask price, which is the price at which you can buy.

Most major pairs display prices to four decimal places, while Japanese yen pairs show only two because the yen is worth less per unit. Some brokers, including Taurex, offer quotes to five decimal places for precision, which is useful for traders focusing on small price movements.

According to TradingView, more than 1,800 currency pairs are available for trading globally, but don’t let that overwhelm you. Just seven major pairs make up 66.3% of all forex trading volume, and EUR/USD alone accounts for about 30% of daily trading.

Think of it like planning a trip from the United States to Europe. You check the EUR/USD rate to see how many dollars one euro costs. In the forex market, the principle is the same, only prices move faster and in larger amounts. If EUR/USD shifts from 1.1700 to 1.1750, a €1,000 budget changes by $50. Understanding these movements is a key part of learning how to read forex quotes effectively.

How Do Base and Quote Currencies Work?

The base currency is the main focus in any currency pair. It always comes first, and all trade calculations revolve around it. In EUR/USD, the euro is the base currency. In GBP/JPY, it is the British pound. One unit of the base currency always equals exactly one in the quote system.

When you buy EUR/USD, you are buying euros. When you sell EUR/USD, you are selling euros. The base currency is what you are actually trading, while the other currency simply facilitates the transaction. Think of it like buying a coffee. The coffee is what you want, and the dollars you pay are just the medium.

TradeTaurex highlights the base currency clearly, making it easier for traders to understand how to read forex quotes without mistakes.

What Is the Quote Currency?

The quote currency, also called the counter currency, plays a supporting but essential role. It tells you the price of one unit of the base currency.

In EUR/USD, the US dollar is the quote currency. A quote of 1.1700 means you need $1.17 to buy €1. Buying the pair means selling dollars to acquire euros, while selling the pair means exchanging euros back into dollars. This constant exchange is the foundation of the foreign exchange market.

On Taurex, the quote currency is displayed alongside bid and ask prices, giving traders an accurate view of how much of the quote currency is required for any transaction.

Why Currency Order Matters

The order of currencies in a pair is not arbitrary. It follows long-standing market conventions. For example, the euro always comes first in any pair it is part of, so you will see EUR/USD, EUR/GBP, and EUR/JPY, but never USD/EUR on standard trading platforms. This standardization simplifies trading and reporting.

The US dollar typically serves as the base currency against exotic currencies but takes a secondary role to the euro and British pound in major pairs. These conventions have developed over decades and remain in place because altering them would confuse traders worldwide.

Reading EUR/USD versus USD/EUR would give very different numbers. EUR/USD at 1.1700 means €1 costs $1.17. Flipping it to USD/EUR would read 0.8547, meaning $1 costs €0.8547. The value is the same, but the perspective changes. Platforms like Taurex maintain these standards consistently, helping traders interpret prices accurately and act with confidence.

Here’s a practical way to think about it:

| Currency Pair | Base Currency | Quote Currency | Quote Example | What It Means |

| EUR/USD | Euro (EUR) | US Dollar (USD) | 1.1700 | €1 = $1.17 |

| GBP/JPY | British Pound (GBP) | Japanese Yen (JPY) | 188.50 | £1 = ¥188.50 |

| USD/CAD | US Dollar (USD) | Canadian Dollar (CAD) | 1.3500 | $1 = C$1.35 |

If EUR/USD sits at 1.1700 and you think the euro will strengthen against the dollar, you buy. You’re betting that soon €1 will cost more than $1.17. If you think the euro will weaken, you sell, betting that €1 will soon cost less than $1.17. Your profit or loss depends entirely on whether you guessed the direction correctly.

Bid Price, Ask Price, and the Spread: What Are the Costs of Trading?

What Is the Bid Price in Forex?

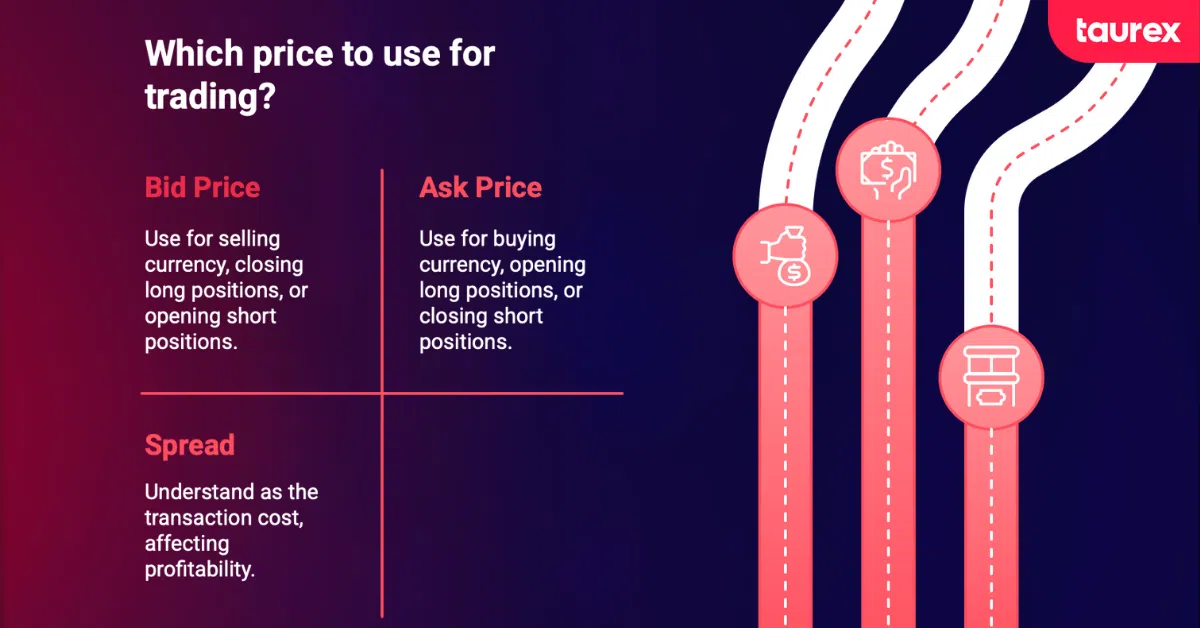

The bid price shows the highest price buyers are willing to pay for the base currency at any given moment. For example, if EUR/USD has a bid of 1.1700, the top buyer in the market is willing to pay $1.17 for each euro.

It is important to remember that you sell at the bid price. Closing a long position or opening a short position always uses this price. The bid is typically lower than the ask because buyers aim to pay as little as possible, while sellers want more.

Understanding bid, ask, spread, and pips is part of mastering the essential terminology every forex trader needs to know.

On Taurex, the bid price is clearly displayed alongside the ask, so traders always know exactly what they would receive if selling the base currency. This transparency helps ensure precise execution and prevents surprises during trade closure.

What Is the Ask Price in Forex?

The ask price (also called the offer price) represents the lowest price at which someone is willing to sell the base currency. For example, if EUR/USD has an ask of 1.1703, that is the price you would pay to buy euros at that moment.

You buy at the ask price. Opening a long position or closing a short position always uses this price. Sellers aim to get the best value for their currency, which is why the ask is always slightly higher than the bid.

The difference between the bid and ask, called the spread, is how brokers earn revenue. Platforms like Taurex display spreads clearly, helping traders plan entries and exits with precision while keeping costs predictable.

What Is the Spread?

The spread is simply the difference between bid and ask prices. It’s your cost of doing business in the forex market, like a tiny toll you pay to enter or exit any trade. Here’s how it works:

EUR/USD Quote: 1.1700 / 1.1703

Bid: 1.1700

Ask: 1.1703

Spread: 0.0003 = 3 pips

That 3-pip spread might seem insignificant, but it adds up fast. Every trade starts with this small loss. If you buy EUR/USD at 1.1703 and immediately try to sell, you’d only get 1.1700 back, instantly losing 3 pips. The price needs to move in your favor by more than the spread before you see any profit.

What Are the Spread Differences Across Currency Pairs?

Not all spreads are created equal. Major pairs like EUR/USD typically have spreads of 0.2 to 3 pips during normal market conditions. These tight spreads exist because these pairs have massive trading volume and liquidity.

Minor pairs see moderate spreads of a few pips, maybe 3 to 10 pips for something like EUR/GBP or AUD/NZD. Still reasonable, but you’re paying more for the privilege of trading less popular combinations.

Exotic pairs are where things get expensive. Spreads can reach 10 to 50 pips or more, making them impractical for most retail traders. Imagine paying $500 in spread costs just to open and close a single standard lot position. That’s the reality with some exotic pairs.

The timing of your trades matters too. During the London-New York session overlap, when both markets are open simultaneously, spreads tighten up due to maximum liquidity. But trade during off-hours or around major news events, and spreads can double or triple in seconds.

Here’s what spread costs look like in real dollars for EUR/USD with a 2-pip spread:

| Lot Size | Units | Value per Pip | Cost of 2-Pip Spread |

| Standard | 100,000 | $10 | $20 |

| Mini | 10,000 | $1 | $2 |

| Micro | 1,000 | $0.10 | $0.20 |

Every trade starts underwater by the amount of the spread. This is why scalpers who make dozens of quick trades daily obsess over finding brokers with the tightest spreads. A scalper making 20 trades with standard lots pays $400 daily in spreads with a 2-pip EUR/USD spread. Find a broker offering 1-pip spreads, and the cost drops to $200. Over a month, that’s $2,000 in savings.

What Are Pips and How to Calculate Them

What is a Pip In Forex Trading?

A pip stands for “percentage in point” or “price interest point,” depending on who you ask. Either way, it’s the standard unit for measuring price movements in forex. For most currency pairs, a pip equals the fourth decimal place (0.0001).

EUR/USD moving from 1.1700 to 1.1701 is a 1-pip move. From 1.1700 to 1.1750 is a 50-pip move. This standardization lets traders compare apples to apples across different currency pairs and brokers.

Japanese yen pairs work differently because the yen is worth so much less per unit. For JPY pairs, a pip is the second decimal place (0.01). So USD/JPY moving from 110.50 to 110.51 is a 1-pip move.

What Are Pipettes (Fractional Pips) in Forex?

Modern trading platforms often show a fifth decimal place for standard pairs (or third for JPY pairs). This extra precision is called a pipette or fractional pip, worth exactly one-tenth of a regular pip.

If EUR/USD moves from 1.17000 to 1.17005, that’s a 5-pipette move, or 0.5 pips. Most retail traders ignore pipettes, but professional traders and automated systems use them to squeeze out tiny edges in high-frequency trading.

Pip Calculation Examples

Let’s walk through some real examples to cement your understanding:

Example 1: EUR/USD Movement

- Opening quote: 1.1500

- Closing quote: 1.1515

- Movement: 15 pips upward (1.1515 – 1.1500 = 0.0015)

Example 2: USD/JPY Movement

- Opening quote: 110.50

- Closing quote: 110.75

- Movement: 25 pips upward (110.75 – 110.50 = 0.25)

Example 3: Fractional Pips

- EUR/USD moves from 1.17225 to 1.17230

- Movement: 5 pipettes or 0.5 pips

Why Pips Matter in Forex Trading

Pips are the standard measure of movement in forex and the universal way to express profit and loss. When a trader says they gained “50 pips,” everyone understands the result, regardless of trade size or currency pair. Think of it like measuring distance in miles: the value is clear even if the vehicle or speed varies.

Here’s how pip movements translate to actual money:

Trade: Buy EUR/USD at 1.1700

Exit: Sell EUR/USD at 1.1750

Movement: 50 pips profit

For standard lot (100,000 units):

50 pips × $10/pip = $500 profit

For mini lot (10,000 units):

50 pips × $1/pip = $50 profit

Understanding pip values helps you calculate position sizes, set stop losses, and manage risk properly. If you can only afford to lose $100 on a trade and you’re trading mini lots ($1 per pip), you know your stop loss can’t be more than 100 pips away from your entry.

What Are Direct and Indirect Quote Conventions?

Not all forex quotes follow the same format, and this can confuse new traders. Depending on where you trade and the currencies involved, you might encounter quotes that seem backward. Let’s simplify this.

What Are Direct Quotes in Forex?

A direct quote shows how much of your domestic currency is needed to buy one unit of a foreign currency. For US traders, EUR/USD at 1.1700 is a direct quote. It tells you exactly how many US dollars you need to buy one euro.

Most quotes you’ll see are direct from a US perspective, which makes sense because roughly 88% of all forex trades involve the US dollar. On platforms like Taurex, direct quotes are clearly displayed, so you can see exactly what you would pay or receive in your base currency.

What Are Indirect Quotes in Forex?

An indirect quote flips this perspective. It shows how much foreign currency you get for one unit of your domestic currency. For example, USD/JPY is an indirect quote for US traders because it tells you how many yen you receive for one dollar.

Some countries, like the UK, Australia, New Zealand, and Canada, traditionally use indirect quotes for their currencies. That is why you often see GBP/USD instead of USD/GBP.

What Are The Differences Between American vs. European Terms?

The market also uses two conventional naming styles that have nothing to do with geography:

- American terms mean the USD is the quote currency, such as EUR/USD or GBP/USD. You see how many dollars each foreign currency costs.

- European terms mean the USD is the base currency, such as USD/JPY or USD/CHF. You see how much foreign currency one dollar buys.

These conventions exist due to historical reasons and trading traditions. Understanding them keeps you from getting confused when reading international financial news or using platforms like Taurex.

How to Read Forex Quotes: A Step-by-Step Tutorial

Reading a forex quote correctly is essential. Think of it like following a recipe. Miss a step, and the result could be costly. Here’s a clear process you can use every time you trade.

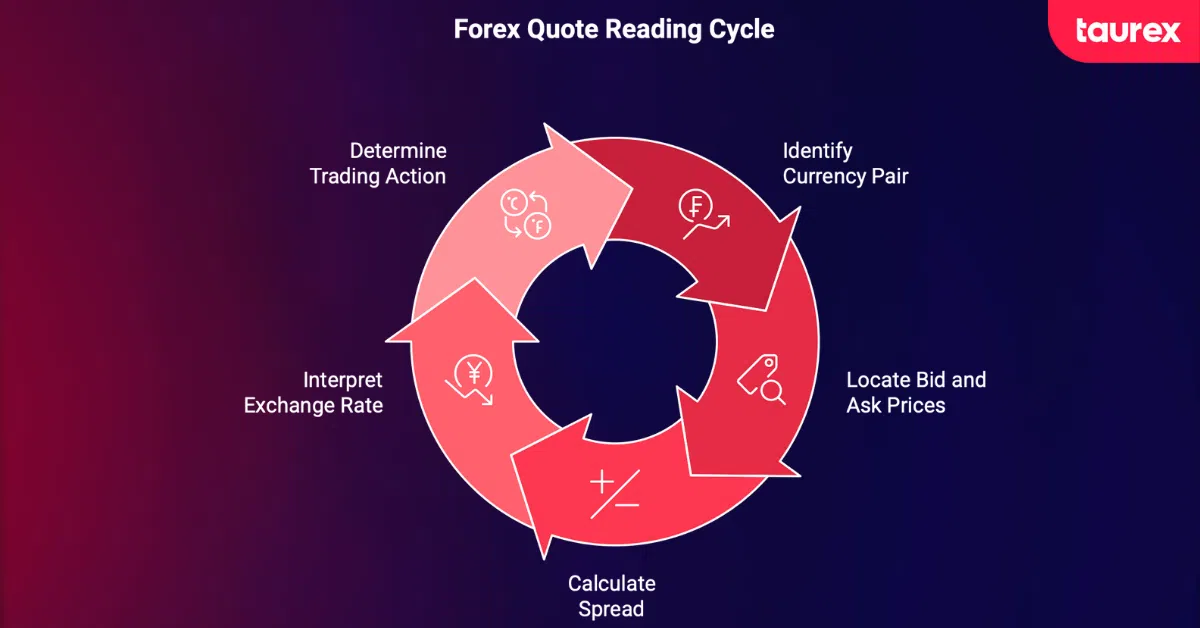

Step 1: Identify the Currency Pair

Read the quote from left to right. The first currency is the base, and the second is the quote. For example, GBP/USD means British pounds versus US dollars. The pound is the base currency, which tells you which currency you are actually trading. Taurex displays the currency pairs clearly and makes it easy to spot the base and quote currencies at a glance.

Step 2: Locate the Bid and Ask Prices

Most platforms display both bid and ask prices. For instance, GBP/USD might show 1.3050/1.3053. The bid (1.3050) is the price you receive when selling. The ask (1.3053) is the price you pay when buying.

Step 3: Calculate the Spread

The spread is the difference between the ask and the bid. In this case, 1.3053 minus 1.3050 equals 0.0003, or 3 pips. This is your immediate trading cost. Every trade starts with paying this small, but crucial, amount.

Step 4: Interpret the Exchange Rate

The ask price of 1.3053 means you pay $1.3053 for each British pound you buy. The bid price of 1.3050 means you receive $1.3050 for each pound you sell. That difference may seem minor, but it matters when trading large amounts.

Step 5: Determine Your Trading Action

Finally, decide your action based on market expectations. If you think the pound will strengthen against the dollar, you buy GBP/USD at the ask price (1.3053). This is going long, aiming to profit if the exchange rate rises.

If you expect the pound to weaken, you sell GBP/USD at the bid price (1.3050). This is going short, aiming to profit if the rate falls.

By following these steps every time, you ensure that reading forex quotes becomes second nature.

Complete Trading Example

Let’s walk through a real trade. You analyze the charts and economic news, deciding the British pound looks strong. Current quote: GBP/USD 1.3050/1.3053.

You buy one mini lot (10,000 units) at the ask price of 1.3053. Your spread cost is 3 pips, or $3 with a mini lot.

The market moves in your favor. GBP/USD rises to 1.3103/1.3106. You close your position by selling at the new bid price of 1.3103.

Your profit calculation:

- Entry: 1.3053

- Exit: 1.3103

- Movement: 50 pips (1.3103 – 1.3053 = 0.0050)

- Gross profit: 50 pips × $1 per pip = $50

- Net profit: $50 – $3 spread = $47

Not bad for understanding a few numbers on a screen, right?

How Forex Quotes Appear on Trading Platforms?

Trading platforms display quotes in slightly different ways, and understanding what you see can be the difference between a profitable trade and an unexpected loss.

Many retail platforms show a single price by default. This is usually the midpoint between the bid and ask. It looks cleaner on charts, but it is not the price you will actually trade at. Professional platforms like MetaTrader 5, which has become the most-used platform globally, typically display both bid and ask prices clearly.

Quote formats vary depending on your broker and platform. Some show a two-way quote, for example, EUR/USD 1.1700/1.1703. Others display a price ladder with the bid and ask stacked vertically. Mobile apps often simplify this further, showing a single price with a small spread indicator.

Real-time quotes are critical for active trading. Delayed prices from financial websites are fine for research, but trying to trade using 15-minute-old data is risky. Your broker should provide real-time quotes with every trading account.

During major market moves, quotes can update multiple times per second. In quieter periods, especially for exotic pairs, updates might come less frequently. How often prices refresh affects your ability to enter or exit trades at the price you want, which is especially important when targeting small moves.

What Are The Key Factors That Influence Forex Quote Movements?

Understanding what drives currency prices helps you anticipate changes and position your trades effectively. Here are the main factors.

Economic indicators are the biggest movers. Central bank interest rate decisions can push currencies sharply up or down within seconds. For example, with the Fed holding rates at 4.25%-4.50%, every FOMC meeting has the potential to move the market. GDP growth, inflation data such as CPI releases, and employment reports like non-farm payrolls also create noticeable volatility.

Central bank policies go beyond interest rates. When the Bank of Japan ended its negative rate policy in 2024, USD/JPY became extremely volatile. The pair moved from 161.950 down to around 143.560 over four months, a huge swing for a major currency pair.

Geopolitical events introduce uncertainty, and markets respond quickly to that. Elections, trade disputes, or military conflicts all affect currency values. Brexit continues to influence GBP pairs years later, and the 2024 U.S. election cycle is already impacting USD pairs. When risk appetite shifts, safe-haven currencies like the Swiss franc and Japanese yen often rise, while higher-yielding currencies like the Australian and New Zealand dollars see selling pressure.

Supply and demand fundamentals matter as well. Around 88% of all forex transactions involve the U.S. dollar. International trade, foreign investment, and speculation create constant pressure on exchange rates. For instance, when a Japanese company buys American goods, it sells yen and buys dollars, directly moving the USD/JPY quote.

What Are the Critical Mistakes Beginners Make (And How to Avoid Them)?

Our experience shows that most trading account losses start with fundamental errors in reading and interpreting forex quotes.

Mistake #1: Confusing Bid and Ask

This one’s embarrassing but incredibly common. You click “buy” and wonder why you’re immediately showing a loss. That’s because you bought at the ask (higher price), but the platform shows your position value at the bid (lower price). The spread is your instant paper loss. Always know which price you’re trading at.

Mistake #2: Ignoring the Spread

We see traders calculate their profit potential without factoring in the spread all the time. You spot a 10-pip opportunity, but with a 3-pip spread, you’re really looking at 7 pips of potential profit. For scalpers making 20 trades a day on standard lots, a 3-pip spread costs $600 per month. That adds up fast.

Mistake #3: Misreading Pip Values

Not all pairs work the same way. Most use four decimal places, but JPY pairs use two. If you think USD/JPY moving from 150.00 to 150.01 is a 1-pip move (it is), but you calculate it like a 0.0001 move, you’ve just miscalculated your position size by a factor of 100. That’s how accounts get blown up.

Mistake #4: Trading Exotic Pairs Without Understanding Spread Costs

Exotic pairs look exciting with their volatility, but those 20-50 pip spreads are killers. That’s $200-500 in transaction costs per standard lot before the market even moves. Stick to majors where spreads are under 3 pips until you really know what you’re doing.

Mistake #5: Not Accounting for Quote Currency in Profit Calculations

A pip does not always carry the same value. For EUR/USD, one pip on a standard lot is $10. For EUR/GBP, one pip is £10, which could equal around $13 depending on the current exchange rate. Ignoring this difference can throw off your risk management and position sizing, making trades riskier than you realize. Always convert pip values to your account currency to ensure accurate calculations.

Mistake #6: Misunderstanding Direct vs. Indirect Quotes

We have seen traders read USD/CAD backwards, thinking 1.3500 means one Canadian dollar buys $1.35 USD. Nope. It means one US dollar buys 1.35 Canadian dollars. Get this wrong and your entire analysis is backwards.

Mistake #7: Assuming Quoted Price is Executable

Charts usually show the mid-price for cleaner visuals, but you can’t actually trade at that price. During volatile markets, slippage can be 5-10 pips or more. If precision matters for your strategy, use limit orders instead of market orders.

Here’s the sobering reality: only about 29% of retail traders achieve any capital gains, and just 1% maintain profitability for more than four consecutive quarters. Most of these failures start with fundamental misunderstandings about how forex quotes work.

Wrapping Up

Learning how to read forex quotes is the foundation of every successful trade. It is the foundation of every trade you place. The bid, ask, spread, and pip values tell you exactly what the market is doing and how much it costs to participate. When you understand these details, you move from guessing to informed decision-making.

Most traders lose money because they treat forex quotes as background noise. Professionals study them like a language. They know what each price movement means, where their costs sit, and how small shifts affect profit or loss.

If you want to trade with precision, start here. Learn how to read forex quotes until it becomes second nature. Once you can interpret these numbers clearly, every strategy, indicator, and chart pattern will make far more sense, and your trades will start to reflect it. Take the next step with our guide on how to read Forex charts, which covers candlestick patterns, chart types, and trend identification to build on your quote-reading foundation.

Using a platform like Taurex can make this easier, with clear real-time quotes and tools that help you track spreads and pip movements effectively.