Social media platforms frequently feature accounts displaying large sums of money and promising trading success, the Telegram groups promising “daily signals,” the stranger sliding into your DMs talking about how Forex changed their life. You may be wondering, is Forex trading legitimate, or is it a scam?

Forex trading is real and widely used. Banks, corporations, and institutions rely on the foreign exchange market every day to manage currency exposure and facilitate global trade. It plays a crucial role in the modern financial system.

While the market itself is legitimate, it has attracted an enormous number of fraudulent operators looking to exploit people who want to participate. According to the Federal Trade Commission, investment scams contributed to $5.7 billion in losses during 2024 alone. And a significant chunk of those losses came from Forex-related schemes.

The positive aspect is that once you understand how legitimate Forex trading works and what scam tactics look like, you can protect yourself. Now let’s break down everything you need to know.

What Legitimate Forex Trading Actually Looks Like

Before looking at Forex trading scams, it helps to understand what real Forex trading is and what it’s not. The Forex market exists to support global trade and investment. Businesses, banks, and institutions need to exchange currencies to operate across borders. When a company in Japan pays a supplier in Europe, yen must be converted into euros. That’s Forex in its most basic form.

The market operates 24 hours a day, five days a week, across different trading sessions in Asia, Europe, and North America. Participants range from central banks and large financial institutions to corporations managing currency exposure and individual traders accessing the market through regulated brokers.

When you trade through a real Forex broker, you are not buying promises or signals, but taking a position on how one currency may move relative to another. For example, you can decide to buy one currency pair if you believe economic conditions support its strength, or sell it if you expect weakness. Taurex, for example, provides access to pricing, executes trades, and maintains clearly stated trading costs such as spreads or commissions.

That’s the legitimate side. It involves real market dynamics, genuine price discovery, and actual currency movements driven by economic data, central bank policies, and global events.

Why Most Traders Struggle, Even with Legitimate Brokers

There’s something that those fancy social media posts rarely mention: trading Forex is actually difficult. Here, we refer to trading with legitimate, fully regulated brokers, not scams.

Many official regulator disclosures show that a large portion of retail traders lose money trading CFDs, including Forex. This isn’t because those brokers are scams. It’s because the market itself is fast, competitive, and unforgiving of mistakes.

Leverage also plays a big role. It can amplify outcomes. Prices can move greatly on economic news or unexpected events. On top of that, emotions often get in the way. Traders may hold losing positions too long, exit winners too early, or change plans mid-trade. It’s important to know that it may take some time to master the discipline.

This distinction matters enormously. Understanding this can help new traders develop realistic expectations and focus on preparation. Losing capital while trading doesn’t necessarily mean you’ve been scammed. It can just mean you’re experiencing what the majority of retail traders experience when they enter a competitive, fast-moving market without adequate preparation.

However, it is important to acknowledge that scams do exist and are widespread. So let’s look at how they operate.

How Forex Scams Actually Work

Forex scams rarely present themselves as obvious fraud, because most are designed to look and sound similar to legitimate trading services. They use familiar language, professional design, and concepts that real traders recognise.

If you understand the structure behind these schemes, it will make them easier to identify. Let’s look at some of the most widespread Forex trading scams:

Signal Seller Schemes

This is often where people start. You are told that you don’t need to understand trading. Someone else will tell you exactly when to buy and when to sell. These instructions are called signals. They usually come through Telegram, WhatsApp, or a private group, and you pay a monthly fee to access them.

On the surface, this sounds helpful. But here is what many people do not realise.

In many cases, the person selling signals is not making money from trading. They are making money from subscriptions. You only have access to the trades they decide to display. Losing trades are often removed, explained away, or never mentioned. Some signal sellers do not trade real accounts at all.

Signals themselves are not automatically a scam. The problem is that, as a beginner, you have no way to judge whether they make sense, how much risk they carry, or what happens when things go wrong. Without transparency and proper context, you are following instructions you do not fully understand with real money on the line.

Unregulated And Fake Brokers

Scam brokers often look convincing, their websites are well designed, and they advertise low costs, fast execution, and generous bonuses. They may even mention regulation to sound trustworthy. The issue is that they are not actually regulated by any recognised authority. That matters because regulation is what gives you basic protection as a trader.

When you deposit money with an unregulated broker, problems often appear later. Your withdrawals can be delayed or blocked, trades can behave strangely, or customer support may stop responding to your questions.

An even more deceptive version is the clone broker. In this case, scammers copy the name and details of a real, regulated company, but change the contact information. You think you are opening an account with a legitimate broker, but your money is going somewhere else entirely.

Social Media And Direct-Message Approaches

Someone contacts you on Instagram, Facebook, or a messaging app. Their profile looks successful, and they talk about trading as the reason their life changed. At first, they may not ask for anything at all.

Over time, they build trust, share stories, and offer encouragement. Eventually, they introduce an opportunity, such as a private group, paid signals, or a mentor who can help you get started.

These conversations are often moved to private messaging apps. This makes it harder for others to see what is happening or warn you.

What is being sold here is not education or a process. It is an image of success. They emphasise confidence and lifestyle over the actual mechanics of trading and associated risks.

Account Management Offers

In this setup, you are told that you don’t need to trade at all. Someone offers to trade on your behalf. You are promised professional management, careful decisions, and steady growth. All you need to do is give them access to your account.

This is where many people lose control.

Once someone else has access, you can’t see every decision they make. Fees can be taken quietly, and trades can be placed without clear reasoning. In some cases, funds are moved without proper explanation.

Legitimate account management does exist, but it operates under strict rules, contracts, and regulatory oversight. The offers you see online rarely meet those standards. If you are being asked to hand over control with little documentation or protection, the risk is extremely high.

Fake Trading Platforms And Mirror Systems

These scams go a step further and create their own platforms. You log in and see charts, open trades, profits, and a growing balance. Everything looks real. It even resembles well-known trading software. These platforms often imitate real trading interfaces but are disconnected from actual market conditions.

However, the platform is not connected to any genuine financial market. The numbers you see are controlled by the scammer.

As long as you keep depositing money, things appear to go well. The moment you try to withdraw, problems begin. You may be asked to pay extra fees, taxes, or verification costs. Delays stretch on with no clear answers.

This is usually when people realise that the platform was never real and that their money is no longer accessible.

What Are 10 Warning Signs of Forex Trading Scams?

Once you know what to look for, Forex scams become much easier to spot. These warning signs show up again and again across fraudulent Forex schemes. Seeing one of them should make you slow down. Seeing several at once is usually a signal to walk away.

1. Promises Of Predictable Outcomes Or Claims Of Eliminated Risk

This is the biggest red flag of all.

Forex markets move constantly and often unpredictably. No one can promise fixed outcomes or trading without potential losses. If you are told you will earn a certain percentage per day or that losses are impossible, you are not being told the truth.

In real trading, risk is always present. Anyone who says otherwise is either misleading you or doesn’t understand the market.

2. Unclear Or Missing Regulation Details

A legitimate broker is open about who regulates them and where. You should be able to see the regulator’s name and a specific licence number, then verify it yourself.

If regulation is mentioned vaguely, hidden in small print, or linked to unfamiliar jurisdictions with no clear oversight, that’s a warning sign. If you can’t confirm it independently, assume you are not protected.

3. Pressure To Act Immediately

Scammers don’t want you to think, compare, or research.

If you are pushed with phrases like “last chance,” “limited slots,” or countdown timers, that pressure is intentional. It’s designed to rush you into a decision before you ask the right questions.

Legitimate brokers and platforms don’t need to hurry you. Regulated brokers typically allow you to evaluate at your own pace.

4. You Didn’t Ask To Be Contacted

Be cautious if someone reaches out to you first.

Cold messages, surprise phone calls, or random DMs offering trading opportunities are not how reputable brokers operate. If you didn’t initiate the conversation, you should be on high alert.

5. They Only Accept Crypto Payments

While crypto is increasingly common, it should not be the sole payment option. If you are told you can only deposit using cryptocurrency, pause.

Crypto transactions are hard to reverse and difficult to trace. Reputable brokers usually offer multiple payment options, including methods that give you some level of consumer protection.

Limited payment choices often benefit the seller, not you.

6. Problems Appear When You Try To Withdraw

Many Forex scams look fine until you ask for your money back.

If deposits are easy but withdrawals suddenly require extra fees, unexpected taxes, or endless verification steps, something is wrong. Silence from support or vague explanations are also major warning signs.

With legitimate platforms, withdrawing should not feel like a battle.

7. Extremely High Leverage Offers

Leverage increases both potential gains and potential losses.

In many regulated regions, there are limits on how much leverage brokers can offer retail traders. If you are being offered extremely high leverage with no warnings or restrictions, it usually means the broker is operating outside proper oversight.

High leverage is often used as bait, not as a benefit.

8. Results That Can’t Be Verified

Screenshots are easy to fake.

If performance claims rely only on images, testimonials, or social media posts, and you cannot verify them through independent sources, treat them with caution. Real track records can be verified. Fake ones rely on trust alone.

9. Pushing Conversations Into Private Apps

A common tactic is moving you from a public platform to private messaging.

This reduces visibility and makes it harder for others to step in or for platforms to intervene. If the shift happens early and aggressively, ask yourself why the conversation can’t stay transparent.

10. They Focus On Lifestyle Instead Of Learning

Pay attention to what’s being emphasised.

Legitimate trading education talks about how markets work, how risk is managed, and how decisions are made. Scam marketing talks about cars, travel, cash, and freedom.

If the message is about what trading can buy you rather than what it requires from you, that’s a sign to be careful.

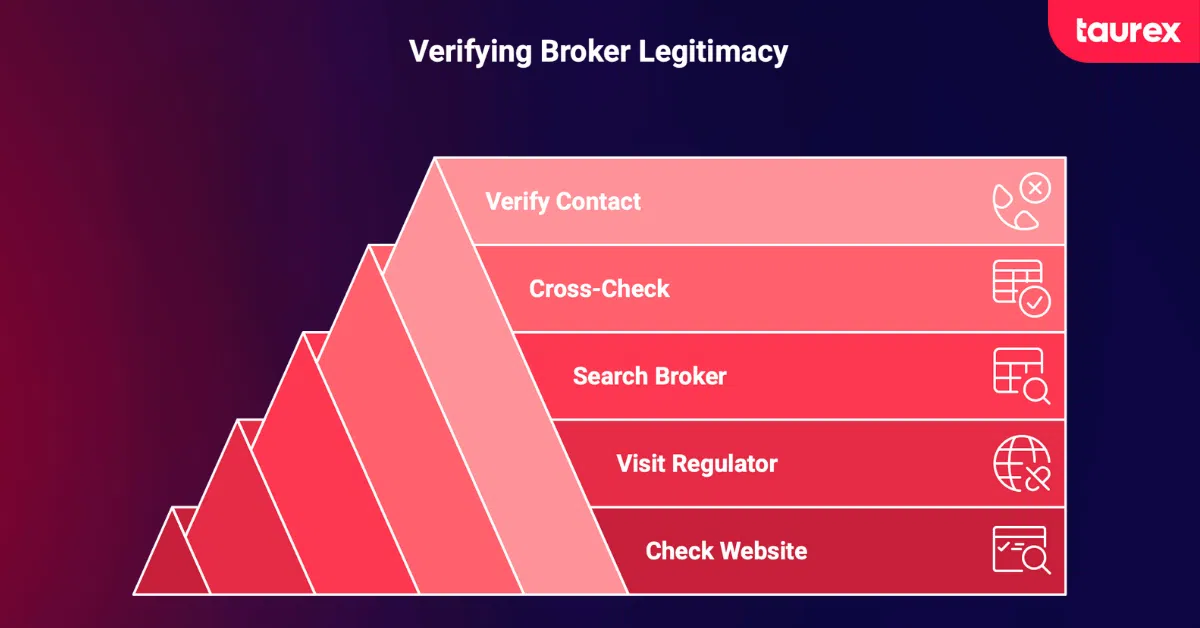

How To Verify A Forex Broker’s Legitimacy

Verifying whether a broker is legitimate only takes a few minutes, but it can save you a lot of money and stress. Here is how to do it safely.

Step 1: Look For Regulatory Details On Their Website

Start by scanning the broker’s website, usually in the footer or the legal or disclaimer sections. You should be able to see

- The name of the regulator

- The broker’s registered company name

- Their licence number

If any of this is missing, unclear, or suspicious, stop right there. That is a red flag.

Step 2: Go Directly To The Regulator’s Website

Don’t trust links on the broker’s site. Go directly to the regulator’s official site to verify the information. Key regulators include

- FCA Register for UK-regulated firms

- ASIC Connect for Australian-regulated firms

- CySEC Entities for Cyprus-regulated firms

- NFA BASIC for US-regulated firms

- CFTC Registration for additional US verification

For example, Taurex is registered in Seychelles and is regulated by the Financial Services Authority of Seychelles under Licence number SD092. We encourage all traders to independently verify this using the FSA database.

Step 3: Search For The Broker

Enter the broker’s name or licence number in the regulator’s search tool. A legitimate broker will appear in the results showing a registered entity that matches their website claims.

Step 4: Cross-Check All Details

Compare the company name, registered address, and licence number with what the broker lists. Scammers sometimes use names that are very similar to real brokers, so check carefully. Also, make sure the licence status says active or authorised. Avoid brokers with suspended or revoked licences.

Step 5: Verify Contact Information Independently

For extra security, call the phone number listed in the regulator’s database and not the one on the broker’s site. Clone firm scams often use real regulatory details but fake contact information. A quick call can confirm you are talking to the real company.

This verification process usually takes five to ten minutes. It is a small time investment for peace of mind and protection against fraud.

What to Do If You’ve Been Scammed

If you suspect you’ve fallen for a Forex scam, acting quickly may help document the incident for authorities, though recovery of funds is rarely possible.

Stop All Communication

The first thing you should do is stop talking to that person or company. Don’t send more money, even if they come up with excuses like taxes, fees, or “release charges.” These are common tricks scammers use to get more from victims.

Gather Evidence

Keep everything, save messages, emails, screenshots, receipts, and website pages. Make a clear timeline of your interactions. Because the more detail you have, the easier it will be to report the scam and try to recover funds.

Contact Your Bank Or Payment Provider

If you paid with a credit card or bank transfer, contact your bank immediately. Ask about chargebacks or payment reversals. The faster you act, the better the chance of getting your money back. If you used cryptocurrency, it will be much harder to recover funds, so try to be extra cautious in the future.

Report to Authorities

Reporting helps prevent others from being scammed. Depending on where you live, you can contact:

- Your local financial regulator (FCA in the UK, CFTC in the US, ASIC in Australia)

- The Federal Trade Commission via reportfraud.ftc.gov

- The FBI’s Internet Crime Complaint Center at ic3.gov

- Local police or law enforcement

Watch Out For Recovery Scams

Be careful after a scam. Some people will contact victims pretending to help recover lost money for a fee. This is usually another scam. Never pay upfront for recovery services. Any legitimate service should be independently verifiable.

Taking these steps quickly can help protect you and may even help recover some of your money. Most importantly, learning from the experience will make you safer in the future.

How to Take Charge of Your Trading Decisions

So is Forex trading legitimate? Yes. The foreign exchange market is one of the largest and oldest financial markets. Banks, corporations, and institutions rely on it daily. The market itself is real.

But the retail trading space has attracted many bad actors. Fraudsters know people seek to develop their trading skills, and they exploit gaps in knowledge and trust. Online, it is easy for them to look convincing.

Protecting yourself comes down to a few key principles. Verify a broker’s regulatory status before depositing any money. Be cautious of anyone claiming predictable or assured trading outcomes. Understand that trading is challenging, requires learning, and carries real risk. Recognise scam warning signs, especially on social media, and do not rush decisions.

We are regulated, prioritise education through Taurex Academy, and do not promise outcomes we cannot deliver. Trading carries risk. Experienced traders often emphasise discipline, strategy, and continuous learning. There are no shortcuts. Learn from those who built their success the right way. Our guide to the top Forex traders reveals the habits, strategies, and mindset of legends like George Soros and Bill Lipschutz.

Traders who prioritise a preparation approach the market with realistic expectations, risk management strategies, and continuous learning. That is what taking charge of your trading really means.

You do not need to risk real money to start learning. A demo account allows you to practice trading strategies without risking capital. Consider exploring this option as part of your learning journey.

Before signing up with any broker, run through the verification steps we have outlined. Verify the regulation, research independently, and ask questions. Spending a few minutes now could save you from falling victim to a scam.

Taking time to verify your broker and develop your skills are important steps in your trading journey. Informed preparation supports more confident decision-making.

Disclaimer: Trading involves significant risk, including the potential loss of principal. Past performance does not guarantee future outcomes. The information provided here is for educational purposes only and should not be considered financial advice. Always conduct your own research and consider your risk tolerance before engaging in any trading activity.

FAQs

Is Forex trading legit with regulated brokers?

Regulated brokers operate under oversight that sets standards for transparency, client protection, and financial practices. However, trading through a regulated broker still involves risk and requires education and preparation.

Are social media influencers allowed to promote Forex brokers?

Influencers can promote brokers, but promotions aren’t a guarantee of legitimacy. Many paid promotions don’t include proper disclosures, and some influencers aren’t required to verify the broker’s regulatory status. Treat influencer endorsements as marketing, not validation.

Can demo accounts be manipulated by scam platforms?

Yes. Some scam platforms use demo environments with unrealistic pricing, zero slippage, or guaranteed order fills to create a false sense of performance. A demo account should resemble live market conditions as closely as possible, including spreads, execution delays, and volatility.

Do Forex scams always involve fake platforms?

Not always. Some scams operate through real trading platforms, but misuse client funds, block withdrawals, or change terms after deposits are made. A familiar platform alone doesn’t guarantee fair or ethical practices.

Does a professional-looking website mean the broker is legitimate?

No. Scam operations often invest heavily in polished websites, fake testimonials, and copied legal pages. Design quality doesn’t replace proper regulation, transparent ownership, and verifiable licensing.

Can scams target experienced traders too?

Yes. Some scams can specifically target experienced traders with advanced tools, managed account offers, or exclusive access claims. Familiarity with trading doesn’t eliminate risk if due diligence is skipped.