The broker you choose can shape your trading results.

Every trade you make depends on how your broker operates: how they handle your orders, what prices you get, and how fast your trades execute. With forex trade volumes at $9.6 trillion in April 2025 and the international forex broker market value over $13 trillion by 2032, the numbers have never been bigger (compareforexbrokers, alliedmarketresearch).

The problem is that if you select the wrong broker type, you’ll encounter hidden costs, poor execution, lost opportunities, and sometimes regrettable losses. The right forex broker, on the other hand, can empower you to take charge of your trading decisions and trade with confidence, even if you’re brand new or already managing institutional funds.

Here’s what you’ll get from this guide:

- The three most common types of forex brokers, explained with examples and visuals

- How each model works, and how it impacts you

- Pros, cons, actual costs, and red flags to avoid

- Ready-to-use tips to match broker types to your trading style, volume, and goals

- The latest 2026 statistics and trends are integrated throughout

- Practical tips to match broker types with your goals

- FAQs and quick tools to help you choose your next broker

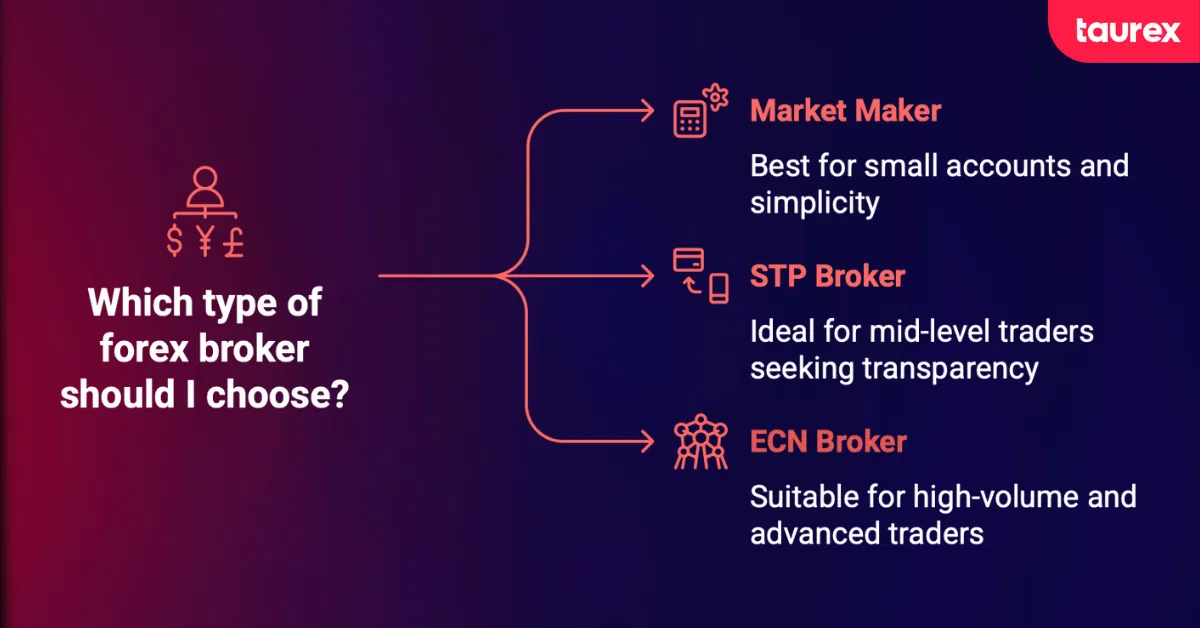

The Three Main Types Of Forex Brokers And Who They Fit Best

Market Maker: Sets its own buying and selling prices and often acts as the counterparty. Offers fixed spreads and instant trades. This one is ideal for small accounts or traders seeking simplicity.

STP (Straight Through Processing): Sends your orders directly to external liquidity providers with little to no manual handling. Prices reflect the real market, and spreads are usually variable. This is ideal for growing traders seeking greater transparency.

ECN (Electronic Communication Network): Connects you directly with banks and other traders, giving access to tight spreads (often near zero) and small commissions. This one is ideal for high-volume and professional traders requiring deep liquidity.

How to choose the correct type of Forex broker:

- Are you a new and small trader? Try a market maker for simple costs.

- Are you experienced and growing? STP brokers offer a nice blend of access and transparency.

- Are you trading professionally or in high volume? ECN brokers bring raw pricing and direct market access.

Types Of Forex Brokers With Real-World Comparisons

Market Makers: The “Storefront” Offering Predictable Trading

Most new traders don’t realise that many forex brokers create their own prices for you. These are market makers.

Definition and Operation

Market makers are the “storefront” of the trading world. Instead of passing your order to a big, messy marketplace, they often fill your trade from their own book, just like a shop selling inventory off the shelf. They quote their own prices and fill your trades instantly when possible. If they can’t, they hedge in the wider market.

Revenue model: Market Makers earn mainly from the difference between the buy and sell prices. In some cases, when you lose, the broker gains the trade, which can create a conflict of interest (as noted by 55Brokers).

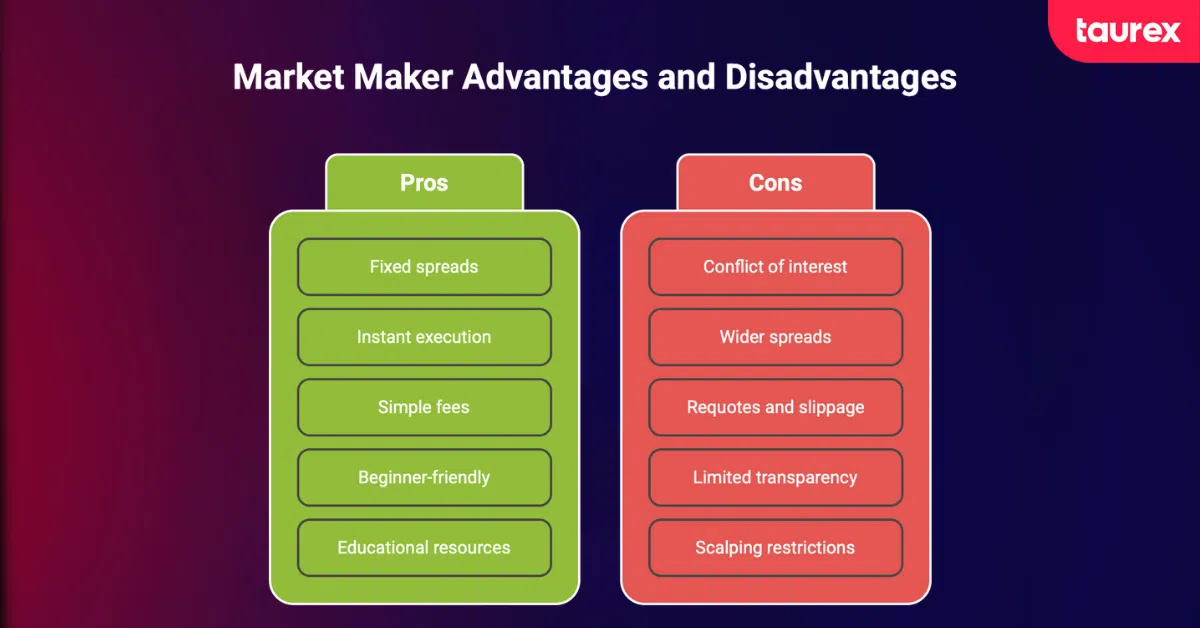

Advantages Of Market Makers

- Fixed spreads: Clear, predictable costs, even during fast-moving markets.

- Instant execution: You get filled at the price you see, with no unexpected adjustments.

- Simple fee structure: Usually, no commissions; the spread represents the total cost.

- Beginner-friendly requirements: Lower minimum deposits, straightforward interfaces.

- Rich educational resources: Many market makers compete for your loyalty with free webinars, demos, guides, and quick-start support.

Disadvantages Of Market Makers

- Wider spreads: You may not get as close to the interbank price, particularly during major news events or low liquidity periods.

- Requotes and slippage: If the market moves quickly, your trade may not get filled at your requested price (or may even be rejected).

- Limited transparency: You won’t see the “real” market depth or external quotes.

- Restrictions on scalping or fast strategies: Some brokers limit high-frequency techniques that might eat into their own margins.

Who are Market Maker Forex Brokers Most Suitable for?

Market Maker Forex brokers are suitable for new traders, small accounts, anyone needing instant pricing with minimal fuss, or those trading lower tick volumes.

STP Brokers: The Middle Way For Balance, Transparency, And Speed

If you want absolute market pricing without the complexity of ECN systems, STP brokers are a balanced option.

How STP Brokers Work

STP stands for Straight Through Processing, meaning your trades zip through the broker’s system directly to its pool of external liquidity providers (big banks, hedge funds, other brokers), with minimal human intervention.

There’s no internal deal desk taking the other side of your trade. Instead, the broker might pass your order to the best available outside price, spraying it out to one or multiple liquidity providers.

Revenue model: STP brokers typically add a small markup to the spread or charge a modest commission per trade. Since they’re not the counterparty, their interests are closer to yours; your wins or losses don’t impact their bottom line directly.

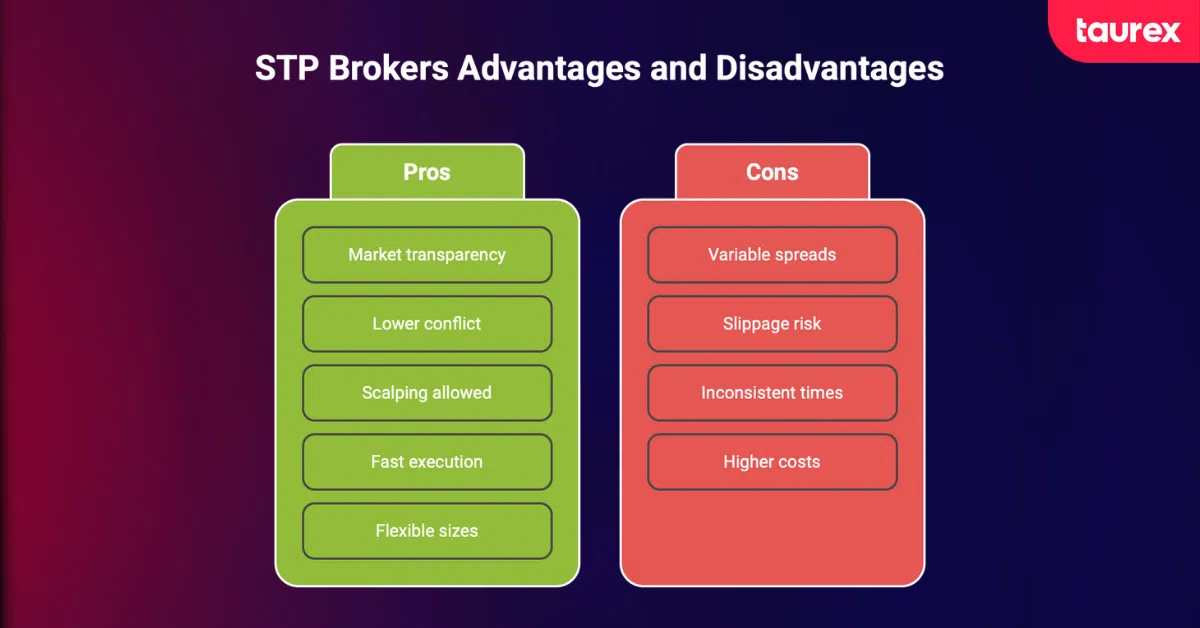

Advantages of STP Brokers

- Market pricing transparency: You’re closer to “true market” prices, with spreads reflecting real conditions.

- Lower conflict of interest: The broker earns from the volume, not your losses.

- Scalping and automation are welcome: Fast strategies and robots (EAs) are typically allowed.

- Execution speed: Virtually instant, assuming good system infrastructure and liquidity.

- Flexible trade sizes: No “mini account only” limitations like some market makers.

Disadvantages of STP Brokers

- Variable spreads: Can widen during volatile or quiet periods.

- Possible slippage: Prices can shift during execution.

- Inconsistent fills: Delays may happen if liquidity drops.

- Costs may rise for large traders: This can especially happen in busy market hours.

Who are STP Brokers Most Suitable for?

STP brokers are suitable for intermediate traders growing their accounts, active day traders, and anyone who wants a step up from fixed-spread models, but not ready for the whole ECN pro territory.

ECN Brokers: Where The Big Boys And Pros Play

If you want real-time pricing, direct market access, and the lowest spreads, ECN (Electronic Communication Network) brokers make this possible. They’re the “pro trading floor,” a digital marketplace hub where you, banks, funds, and other traders all trade directly.

How ECN Brokers Operate

An ECN broker connects you to a trading network made up of banks, funds, and other traders. Your orders are matched directly with others on this network, and there’s no dealing desk involved. You’ll often see “Level two” quotes showing real market depth and order flow.

Revenue model: Instead of making money off your losses, ECN brokers charge a commission per trade (often $3-7 per lot) and pass on interbank spreads as is, which are usually razor-thin (sometimes as little as zero pips).

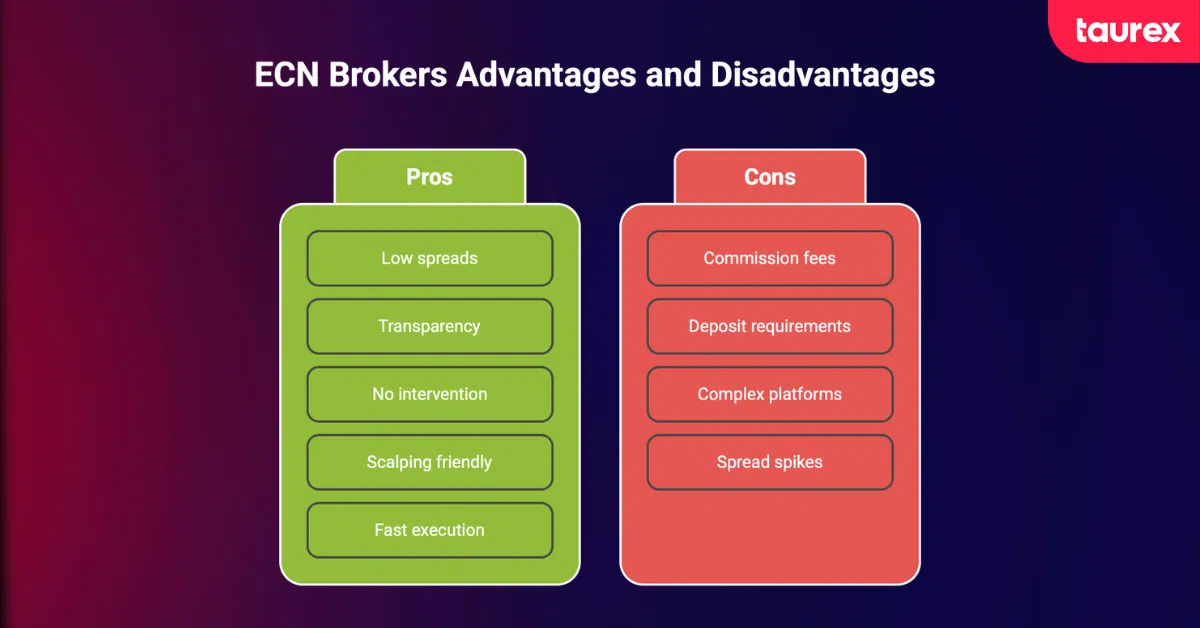

Advantages Of ECN Brokers

- Ultra-low spreads: Sometimes close to zero, especially during peak liquidity.

- Transparency: You can see order flow and market depth for more informed decisions.

- No dealer intervention: No behind-the-scenes tweaking, every trade matches another participant.

- Scalping and large orders welcome: Designed for speed and volume.

- High-speed execution: Milliseconds matter, and you get them here.

Disadvantages Of ECN Brokers

- Commission fees add up: Even if the spread is nearly zero, you still incur a cost per trade, which can erode profits on smaller positions.

- Deposit requirements: Minimums can start at $50-$100, sometimes higher, depending on the broker and your region.

- Complex platforms: ECN platforms often require more know-how and don’t “hold your hand.”

- Spread spikes during news: Interbank spreads can experience significant volatility, resulting in wider costs.

Who are ECN Brokers Most Suitable for?

ECN brokers are suitable for high-frequency traders, professionals, institutions, and individuals with sufficient volume or account balance (exceeding 25 standard lots/month or $5,000) can benefit from commission structures that work in their favor.

Broker Comparison Table: Market Maker vs STP vs ECN (20262025 snapshot)

| Feature | Market Maker | STP | ECN |

| Order Handling | Broker’s internal | To the liquidity pool | To the electronic marketplace |

| Pricing Model | Fixed spreads | Variable spreads | Interbank spreads + commission |

| Execution Speed | Instant (in-house) | Fast (dependent on liquidity) | Fastest (network matching) |

| Transparency | Low | Medium | High |

| Min. Deposit | Low | Low/Medium | Medium/High |

| Scalping/EAs Allowed | Sometimes limited | Usually allowed | Always allowed |

| Conflict of Interest | Can exist | Minimal | None |

| Best For | Beginners | Intermediate, growing | Pro, institutional |

How To Choose The Right Broker For Your Trading Style

You don’t need a finance degree to understand this. Only some self-reflection and a clear assessment of your needs will be enough. Follow these steps:

1. Assess Your Experience

- If you are a beginner trader, look for education, simple spreads, and support (market maker or basic STP).

- If you are an intermediate, try STP for variable pricing and fewer restrictions.

- Are you an advanced/pro Forex trader? Go ECN for cost savings on large trades and unbeatable transparency.

2. Match Your Trading Style

- If you are interested in scalping, news trading, or high-frequency trading, ECN is designed for speed and minimal restrictions.

- If you prefer longer-term swing or position trading, fixed spreads from market makers may be more cost-effective.

- However, if you want to mix strategies, STP brokers offer flexibility without the full complexity.

3. Consider Trading Volume And Capital

- If you trade less than 25 lots/month or have less than $5,000, a lower-cost, lower-barrier market maker or STP model is a suitable option.

- If you are trading over 25 lots/month or running $5,000+, the math often favors ECN, despite commissions.

4. Regulatory And Safety Checks

- Check regulation status, look for licenses from respected authorities (FCA, ASIC, CFTC, etc.).

- Research fund safety (segregated accounts, insurance coverage).

- Read reviews for withdrawal reliability, platform uptime, and real user experiences.

5. Test Before You Commit

- Most platforms offer demo accounts; use them to test spreads, order execution, and platform features in a practical setting.

Common Myths, Red Flags, And How To Protect Yourself

Even experienced traders can make poor choices due to common misconceptions or misleading marketing. The following points address frequent misunderstandings and warning signs.

Myth 1: All Regulated Brokers Are Equally Safe.

While regulation is key, the quality of regulation matters. Some offshore regulators provide limited protection. Strongly regulated brokers (Taurex, for instance) offer fund segregation and compensation programs that some offshore-regulated brokers skip.

Myth 2: Tighter Spreads = Always Better.

Spreads represent only part of the total cost. Commissions, slippage, and execution quality are equally important. For smaller traders, an STP broker with slightly wider spreads may still be more affordable than an ECN broker with per-trade fees.

Red Flags To Watch For

- Unregulated or barely regulated brokers: High risk of withdrawal issues and account freezes.

- Guaranteed profit claims: If a site promises you “risk-free returns,” run the other way.

- High-pressure sales tactics: Good brokers let their platforms and conditions speak for themselves.

- Withdrawal complaints: check independent forums, not only broker websites. Learn how to identify warning signs and protect your capital in our guide on how to spot Forex trading scams.

Regulatory Importance

Choosing a broker regulated by top-tier authorities means your money is kept separate, and you have recourse in disputes.

Where Forex Brokerage Is Heading In 20262025 (And Beyond)

The forex brokerage landscape continues to evolve. Many companies now operate hybrid models that combine features of market maker, STP, and ECN structures. These approaches offer both competitive pricing and accessible trading environments.

Technology is also shaping execution speed and pricing accuracy. Artificial intelligence and automated order routing are improving trade matching and reducing delays. Modern platforms are becoming more efficient, while regulatory frameworks are expanding across regions to improve client protection.

For example, Taurex has introduced flexible account types that comply with regional regulations while maintaining global market access.

FAQs: Fast Answers To Common Broker-Type Questions

What is the main difference between STP and ECN brokers?

STP brokers send orders to external liquidity providers, often with a small markup. ECN brokers connect traders directly to a broader network and charge commissions for access to interbank spreads.

Can market makers “trade against me”?

In some cases, yes. Because they take the opposite side of client trades, potential conflicts of interest can occur. Reputable market makers minimise this risk through strict internal controls.

What type of broker is best for beginners?

If you value simplicity, quick setups, and instant fills, market makers are a solid starting point. STP brokers are also suitable for those who want to transition to live market pricing without added complexity.

Is ECN always cheaper?

Not always. For high-volume traders, ECN models typically offer the best prices. However, if you trade infrequently or in small lots, per-trade commissions may eat into your gains.

How do I spot a scam broker?

Look for hard-to-find regulatory info, over-the-top bonuses, pushy sales calls, and endless account withdrawal delays. Check online for honest reviews and see if the broker appears on trusted regulator watch lists.

Do all brokers offer demo accounts?

Nearly all reputable brokers offer demo accounts, but features will vary: test the spreads, speed, and tools before you commit real funds.

Take Charge Of Your Trading Decisions With The Right Broker

Choosing your forex broker is one of the most important decisions for any trader. Always read the terms carefully, verify regulations, and test the trading platform before funding your account.

If you are ready to strike out with confidence, open a free demo account to put what you’ve learned into practice.

Trading involves significant risk, including potential loss of principal. Past performance does not guarantee future results. The value of investments may fluctuate, and you may receive back less than your original investment.

For deeper learning and structured education, join the Taurex Academy for simplified insights.

Risk Warning: Trading leveraged products involves significant risk and may result in the loss of your invested capital. Past performance is not a reliable indicator of future results.