Picture this: while you rest, an algorithm continuously monitors the markets, identifies key opportunities, and executes trades precisely when the conditions are right.. That may sound like a dream, but it is what forex algorithmic trading does today, and it is flipping how traders act in the foreign‑exchange world.

The industry reports that about 60% of all forex trades are carried out by automated systems, often called trading bots. This shift isn’t limited to banks; many individual traders are now adopting these tools as well, aiming to level the playing field.

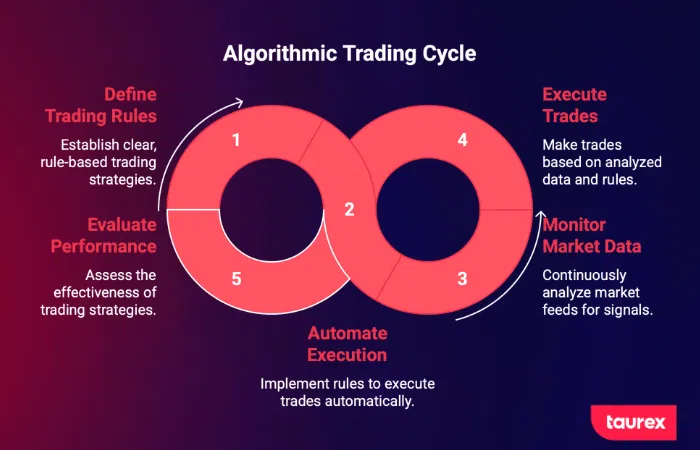

Forex algorithmic trading (also known as algo trading in forex) basically means writing a computerised set of rules that decides when to buy or sell. There’s no need to watch candlestick patterns all day long. You set the criteria once, and then the program follows them, keeping the process steady and free from fear or panic, regardless of how volatile the market becomes.

In this guide, you will find a few tested strategies, instructions on getting them up and running, and an overview of platforms like TradeTaurex’s MT5, which aim to make automation accessible to beginners. Therefore, whether you just want a little help on your own trades or plan to hand everything over to a bot, the forex outlook changes a lot for you.

What Are The Fundamentals of Forex Algorithmic Trading?

Forex Algorithmic Trading Fundamentals

Algorithmic trading involves writing code that executes trades automatically when specific market conditions are met. Imagine a helper that never gets sleepy, never doubts itself, and works with numbers.

There are three ideas to sort out. First, algorithmic trading refers to any rule-based method of entering the market. Second, automated trading means that those rules actually place orders without a human having to push a button. Third, Expert Advisors, or EAs, are the programs you load onto a platform like MetaTrader to execute the rules.

When prices shift, the code scans massive feeds – including price ticks, order flow, chart patterns, and even news sentiment – in a flash. It appears to check those feeds against the written rules and may decide to act in a few milliseconds. For example, an EA could be set to buy EUR/USD when the 20‑day moving average crosses above the 50‑day line, as long as volume and swing are within certain limits.

This systematic approach removes the emotional component that often derails manual trading. Fear, greed, and hesitation – common human responses to market volatility – simply don’t exist in algorithmic systems. The program executes trades based purely on data and predefined logic.

TradeTaurex’s MT5 platform supports both ready-made Expert Advisors and custom algorithm development through the MQL5 programming language, providing flexibility for traders who want to automate their unique strategies or adapt existing ones to their specific trading goals.

Why Every Forex Trader Should Consider Forex Algorithmic Trading?

The advantages of forex algorithmic trading extend far beyond simple automation. Consider these compelling benefits that explain why smart traders are making the switch:

24/7 Market Coverage: Forex markets operate across different time zones, with major sessions in London, New York, and Tokyo creating opportunities around the clock. While you sleep, your algorithm can capitalize on Asian session volatility or the European market opening. This continuous operation ensures that you never miss high-probability setups due to inconvenient timing.

Lightning-Fast Execution: In forex markets where prices can shift in milliseconds, speed matters tremendously. Algorithms can identify opportunities and execute trades faster than any human trader. When a news event triggers sudden market movement, your system responds within microseconds rather than the several seconds it would take to manually process the information and place orders.

Systematic Backtesting: Before risking real capital, algorithms can be tested against years of historical data to validate their effectiveness. You can see exactly how your strategy would have performed during various market conditions, including major economic events and periods of high volatility.

Emotional Discipline: Unlike humans, a computer isn’t influenced by fear or greed. The program does not panic after a loss nor boast after a win. It maintains the same trade size and adheres to stop-loss rules, without second-guessing.

Scalability: When a method works, it can be applied to many pairs, such as EUR/USD, GBP/JPY, and AUD/CAD. That spreads risk and likely increases the chances of winning for the trader.

Platform Benefits: TradeTaurex offers tight spreads starting at 0.0 pips, allowing algorithms to run efficiently even at high speeds. The service claims 99.9% uptime; therefore, systems stay alive 24/7. Nonetheless, users should watch for glitches and update the code now.

What Are Some Proven Algorithmic Trading Strategies for Forex Success?

Best Algorithmic Trading Strategies

Trend Following Algorithms

These are among the simplest trading bots. Their goal is to identify a clear market trend and follow it for as long as it lasts. For example, a rule could be: buy when the price breaks above the 20-day high with rising volume, and sell when it falls below the 10-day moving average.

The strategy is designed to “ride the wave” of momentum, but it isn’t foolproof—if the trend is short-lived or reverses quickly, losses can occur. That’s why these algorithms also include risk controls to limit exposure.

Mean Reversion Strategies

These assume the price goes back to an average after a spike. Traders look at Bollinger Bands or RSI. For example, they could sell at the upper band when RSI is over 70, hoping for a return to the middle band. It works best in sideways markets, but a new trend can quickly turn a safe trade into a loss.

Scalping Algorithms

Scalpers aim for profits from many quick trades. Positions may last only seconds or minutes. Profit comes from volume, not big swings. Speed and low commissions are essential. Tight spreads can help, but fast connections are critical. Even minor execution errors can erase profits, making a reliable broker indispensable.

News‑Based Trading

These bots scan economic calendars, news feeds and social media. When a major announcement is made, they aim to enter the market before the wider crowd reacts. For example, they might buy after a surprise rate cut or sell if unemployment data is worse than expected. Real-time information is essential. Still, many traders consider this approach risky.

Machine Learning Strategies

Machine learning seeks out patterns that humans may overlook. Models continually update as new price data arrives and then provide buy or sell signals. Because they adapt, they could survive changing market conditions. Critics argue that they are opaque and require extensive data; they can overfit and fail when conditions change.

Each overall financial style often fits different markets and risk levels. Trend followers like moves; mean reversion prefers calm periods; scalping requires fills; news trading relies on fresh information; machine learning aims to continue learning.

Step-by-Step Guide to Creating Your Automated Trading System

Building an effective algorithmic trading system takes a step‑by‑step plan. It turns vague ideas into precise rules that a computer can follow, which may mean fewer mistakes when you go live.

1. Define Your Strategy with Clear Numbers

Write down precisely what you expect the bot to do. Instead of “buy when price is up,” you might say “buy when the 20‑period EMA crosses above the 50‑period EMA and price stays above both lines.” List entry signals, exit signals, how big each trade should be, and how you’ll cut losses. Keep all of this in a short note before you start coding; otherwise, you’ll forget details later.

2. Pick a Development Platform

MetaTrader 5 is often chosen because it offers a solid coding environment and easy backtesting. The MQL5 language allows you to modify almost anything, and it is compatible with many brokers. Many believe it performs well across different market conditions, making it a relatively safe choice.

3. Write the Code and Test It

Turn the written rules into code, whether you type MQL5 yourself or use a visual builder. Start with simple buy‑sell logic, then add trailing stops or multi‑timeframe checks later. If you’re not comfortable programming, there are ready‑made experts you can download. Some traders even use point‑and‑click tools, which can be more beginner-friendly.

4. Backtest and Tweak

Run the strategy on several years of past data using MT5’s tester. Look beyond profit; check maximum drawdown, win rate, average trade length, and how it behaved in volatile periods. Adjust parameters slowly, because overfitting can yield impressive past results but poor future outcomes. Moreover, test the idea in different market phases to see if it holds up.

5. Try a Demo, Then Go Live

Start with a demo account to see if the robot works in real time. Watch for slow execution, slippage, or glitches that weren’t obvious in the test. When things appear solid, trade with small position sizes in a live account and scale up only if the system remains steady. In conclusion, taking time to build and test reduces the urge to jump in with an unproven bot and usually leads to better returns.

What Technology Stack Do You Need for Forex Automation?

The technology base that supports your algorithmic trading can significantly impact how fast and scalable the system operates. Knowing parts may help you pick the right tools and spend money wisely.

Picking a platform serves as the foundation of any setup. MetaTrader 5 offers a wealth of features for forex bots. It has thousands of ready-made indicators and Expert Advisors, with community advice. Its strategy tester claims tick‑by‑tick backtesting, and MQL5 lets you code scripts or multi‑asset plans. Therefore, many traders favour it. Traders also back‑test on data that mirrors market behaviour, boosting confidence before live trades.

Using a VPS helps avoid connection issues. Many professional traders host their code near the broker’s server, reducing latency and ensuring trades continue even if their home internet fails. This can keep the algorithm alive during maintenance.

TradeTaurex’s MT5 offering comes with some notable perks. One-click trading allows quick adjustments when needed, and the platform supports forex, commodities, and indices simultaneously. A market-depth view displays liquidity, helping traders decide where to place orders.t.

Accurate data lies at the core of any effective bot strategy. Price streams must remain accurate, and past data used for testing should align with what you can actually trade. TradeTaurex pulls feeds from several tier‑1 liquidity sources, aiming for fewer gaps and reliable back‑tests. In conclusion, a solid tech stack, proper hosting, and clean data collectively enhance algorithm performance.

How to Manage Risks Related to Forex Algorithmic Trading and Avoid Common Mistakes

Forex algorithmic trading risk management

Algorithmic trading presents both opportunities and risks, making risk management a vital component for achieving lasting success.

The most immediate risk is technical failure. Internet outages, server crashes, or software bugs can leave trades unattended or prevent stop-loss orders from executing. Professional traders typically maintain backup computers and monitoring rules that can quickly identify issues. They also set limits on how prominent a position a program can hold, which helps prevent a single fault from ruining the entire account.

Then there are black‑swan moments – events that are rare but hit hard. The Swiss National Bank’s surprise monetary move in 2015, or the March 2020 COVID crash, created market conditions that most algorithms had never encountered. During those bursts, daily loss caps and an emergency shutdown routine may keep damage low.

A softer threat comes from over‑optimizing. When a model is overfit to past data, it often fails once live market conditions shift. This “curve fitting” causes the program to memorise history instead of learning real patterns. The solution is to test the code on unseen data and accept slightly lower historical returns in exchange for more reliable future performance.

Position sizing and leverage are even more crucial when a bot is in control. Rather than using a fixed lot size, a good algorithm calculates the trade size based on the account balance and recent volatility. That way, risk stays steady as the account grows or shrinks.

TradeTaurex’s system incorporates safety features such as maximum loss limits, equity stop-outs, and live margin checks. Those tools add extra protection, helping traders maintain control over their exposure even when the robot runs independently.

Finally, continuous monitoring is necessary, despite automation. Successful coders typically review results frequently, study unusual outcomes, and adjust their models as markets evolve. That ongoing care separates the traders who earn over the years from those who just set it and hope it works, which often ends badly.

Therefore, staying alert and ready to act can transform risks into learning opportunities and keep the portfolio thriving in the long run.

Start Your Algorithmic Trading Journey Today

Forex algorithmic trading is more than just a technological trend – it may signify a shift to a more systematic, disciplined, and potentially profitable approach to market participation. The steps described earlier resemble a map that can transform a reactive, hand-worked style into a proactive, automated one.

The upside appears clear: markets are covered 24/7, decisions are free from emotion, trades occur in a flash, and strategies can be tested against years of historical data. Those points explain why more and more forex volume appears to be moving to algorithms each year.

But success does not come instantly. Building a trading system requires patience, discipline during testing, and an ongoing commitment to review and refine. Traders who put in that effort often see steadier returns and far less time spent compared to manual work.

Why not consider applying this approach to your own forex plan? TradeTaurex offers the MT5 platform, equipped with the tools you need to begin automating your trades. Start with a demo account to explore Expert Advisors and test your first code-based strategies without risking real money. The platform offers practical tools, tight spreads, and reliable execution—an environment suited for both learning and live trading.

Take the first step now. Open a TradeTaurex demo and see if algorithm forex trading could match your financial goals.