In the United States, the Manufacturing PMI fell to 47.0 while the Services PMI rose to 55.4, indicating a divergence in sector performance. Consumer Confidence decreased to 98.7, although new home sales increased to 716K, and oil inventories saw a significant drop of 4.471 million barrels, with unemployment claims falling to 218K. Durable Goods Orders remained unchanged at 0%, while Core PCE rose to 2.7%, and Michigan Consumer Confidence increased to 70.1. In the Eurozone, the Manufacturing PMI dropped to 44.8, and the Services PMI stood at 50.5. The United Kingdom reported a Manufacturing PMI of 51.5 and a Services PMI of 52.8. Meanwhile, Switzerland cut interest rates from 1.25% to 1.00%, and Canada’s GDP grew by 0.2% month-over-month. In Australia, the RBA maintained interest rates at 4.35%, with a Manufacturing PMI falling to 46.7 and Services PMI at 50.6. Japan’s Manufacturing PMI decreased to 49.6, while its Services PMI rose to 53.9, alongside a Tokyo CPI of 2.0%.

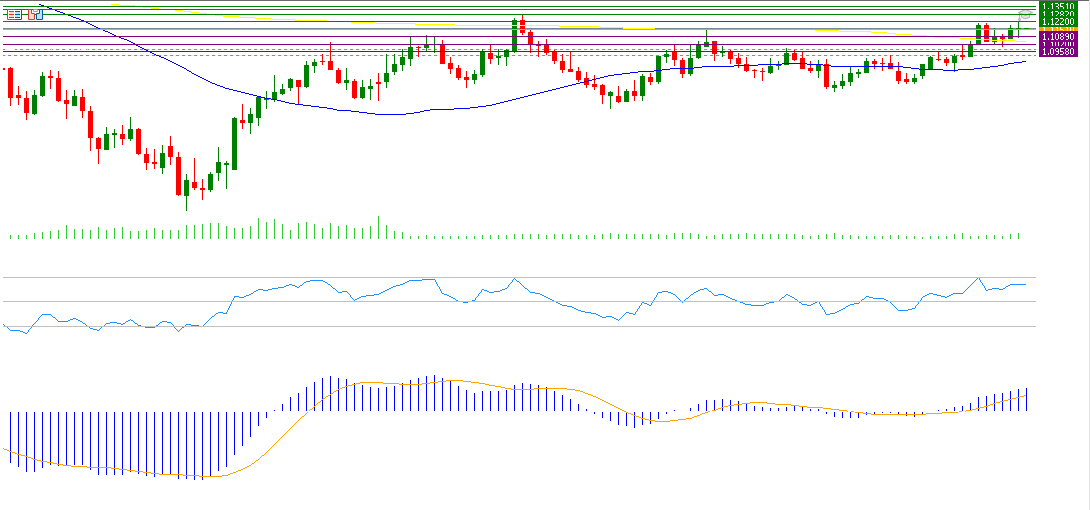

EUR/USD

The exchange rate for the euro against the dollar reached 1.1214 last week, marking its highest level since July 20, 2023, due to the weakness of the U.S. dollar.

If the pivot point of 1.1151 for the euro against the dollar is broken, there is a possibility of targeting support levels at 1.1089, 1.1020, and 1.0958. If the pivot point is surpassed, it may target resistance levels at 1.1220, 1.1282, and 1.1351.

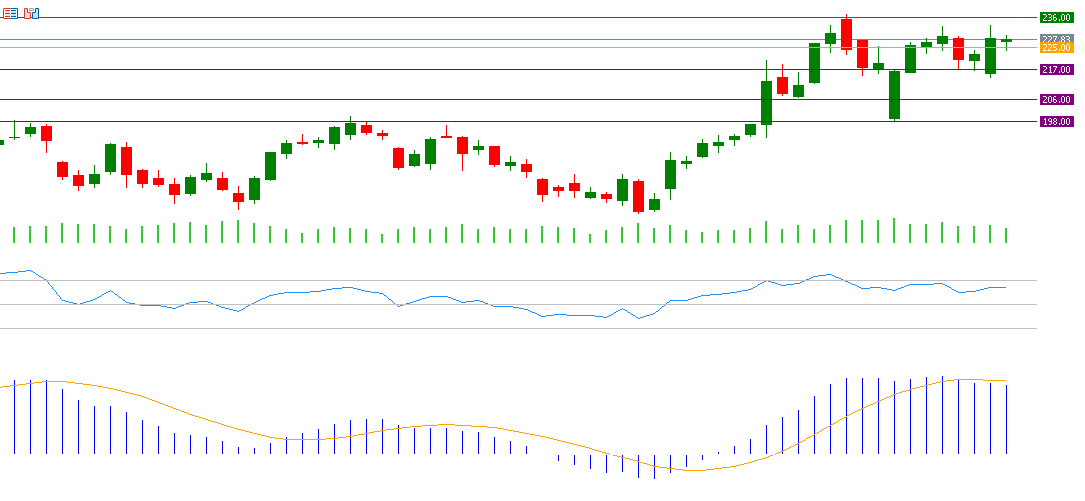

Apple (AAPL)

Apple’s stock traded in a sideways direction last week within the range of $224 to $229. Markets are awaiting the release of Apple’s financial results for the third quarter of this year on October 24, 2024, where expectations are for earnings of $1.60 per share, up from $1.46 per share in the previous report. As for revenue, markets anticipate it will reach $94.51 billion, compared to $89.5 billion in the prior reading.

If the pivot point of $225 for Apple shares is broken, there is a possibility of targeting support levels at 217, 206, and 198. If the pivot point is surpassed, it may target resistance levels at 236, 244, and 255.

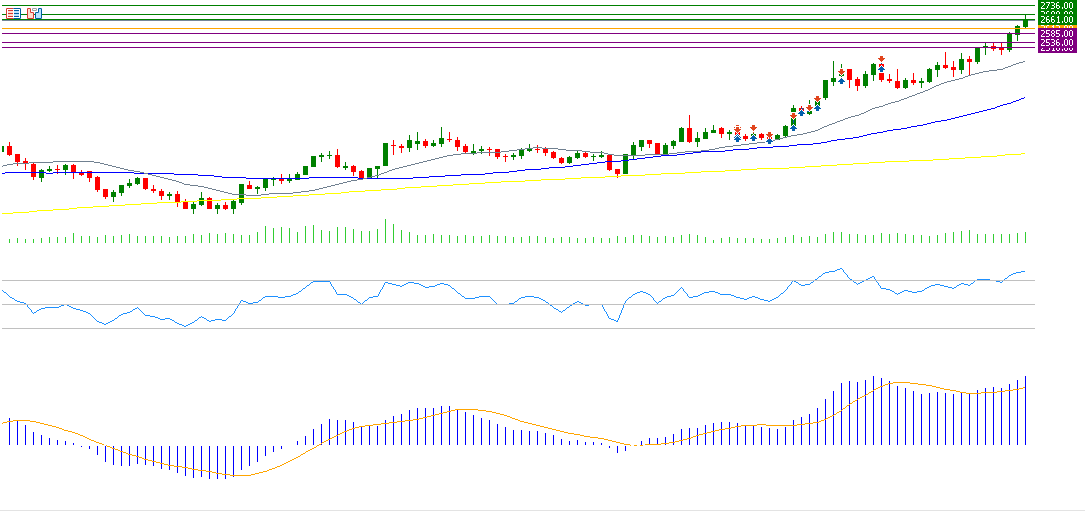

Gold (XAU)

The price of gold reached $2,685 last week, marking its highest level ever, thanks to a 50 basis point cut in U.S. interest rates and ongoing geopolitical tensions in the Middle East, as well as the Russia-Ukraine war.

If the pivot point of 2,612 for gold is broken, there is a possibility of targeting support levels at 2,585, 2,536, and 2,510. If the pivot point is surpassed, it may target resistance levels at 2,661, 2,688, and 2,736.

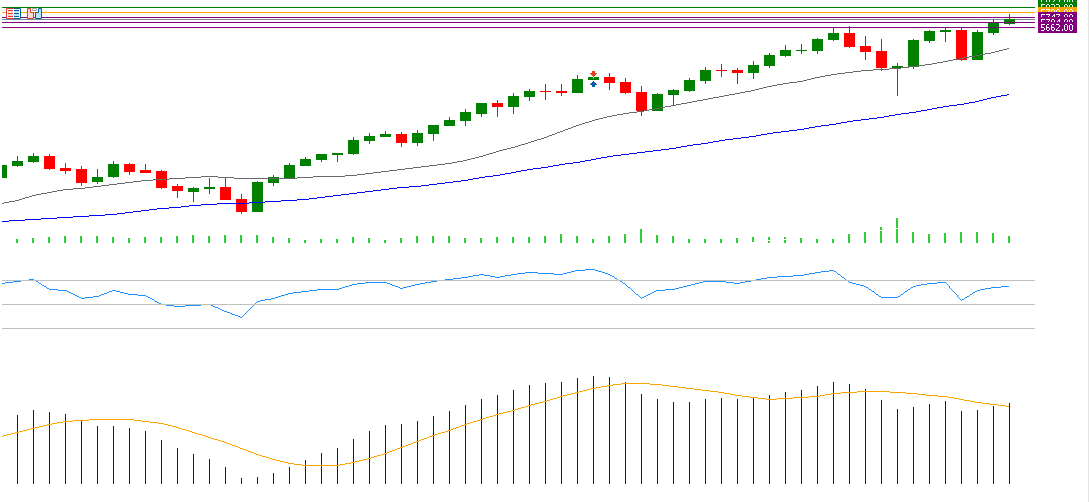

S&P 500

The S&P 500 index reached 5,767 points, a new record high last week, thanks to a 50 basis point reduction in U.S. interest rates by the Federal Reserve. With expectations for continued rate cuts in the coming phase, this may support the S&P 500 index.

If the pivot point of 5,788 for the Dow is broken, there is a possibility of targeting support levels at 5,747, 5,704, and 5,662. If the pivot point is surpassed, it may target resistance levels at 5,832, 5,873, and 5,917.

Key Events This Week

Markets are awaiting several important economic indicators and data this week:

- Today, the Retail Sales and Industrial Production indices for Japan will be released, along with the Manufacturing and Non-Manufacturing PMIs from Caixin in China, as well as the GDP in the UK. The market is also anticipating remarks from U.S. Federal Reserve Chairman Jerome Powell.

- On Tuesday, the markets will watch for the Building Permits and Retail Sales indices in Australia, Retail Sales in Switzerland, and the Manufacturing PMIs for the Eurozone, the UK, and the U.S., along with the Consumer Price Index in the Eurozone and indicators for Construction Spending, ISM Manufacturing PMI, and Job Openings in the U.S.

- On Wednesday, the markets will focus on the unemployment rate in the Eurozone, as well as the ADP Non-Farm Employment Change and U.S. crude oil inventories.

- On Thursday, the Consumer Price Index in Switzerland, the Services PMIs for the Eurozone, the UK, and the U.S., the Producer Price Index in the Eurozone, and indicators for Unemployment Claims, Factory Orders, and ISM Non-Manufacturing PMI in the U.S. will be released.

- Finally, on Friday, the unemployment rate in Switzerland, the Construction PMI in the UK, and Non-Farm Payroll reports, including unemployment rate and average hourly earnings in the U.S., along with the Ivey PMI in Canada, will be published.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.