Last week saw the release of a wide range of global economic data reflecting a mixed slowdown in economic activity. U.S. indicators showed a combination of improvement in the labor market—evidenced by a decline in initial jobless claims—contrasted with weakness in the negative ADP employment report. Consumer confidence improved, but manufacturing and services PMIs slowed, and the core Personal Consumption Expenditures (PCE) index declined.

In the Eurozone, industrial activity continued to contract while services improved, accompanied by a rise in headline inflation and a decline in producer prices.

In the U.K., the manufacturing sector remained steady while services slowed and the construction sector saw deeper contraction. Switzerland reported strong retail sales growth alongside a decline in inflation.

Canada recorded solid job growth and a decline in unemployment, while Australia posted moderate PMI growth and a slowdown in GDP.

In Japan, industrial activity continued its contraction while services saw slight improvement, accompanied by a sharp drop in household spending. In China, both manufacturing and services remained under pressure despite some marginal improvement in certain readings.

Overall, the data painted a global picture of economic deceleration combined with moderate inflationary pressures—keeping monetary policy decisions at the center of investors’ attention going forward.

Market Analysis

USD/SEK Pair

The U.S. dollar against the Swedish krona has been trading for two months within a sideways range between 9.3500 and 9.6000, searching for a clear upward or downward trend. The pair has fallen about 15% year-to-date and is currently trading near 9.4000.

Notably, the Swedish krona continues to outperform other G10 currencies against the U.S. dollar, followed by the euro, Swiss franc, Norwegian krone, Australian dollar, British pound, Canadian dollar, New Zealand dollar, and lastly the Japanese yen.

Recent Swedish economic data shows strong resilience, while the U.S. dollar remains under selling pressure against most major currencies, especially in the context of expectations for U.S. interest rate cuts.

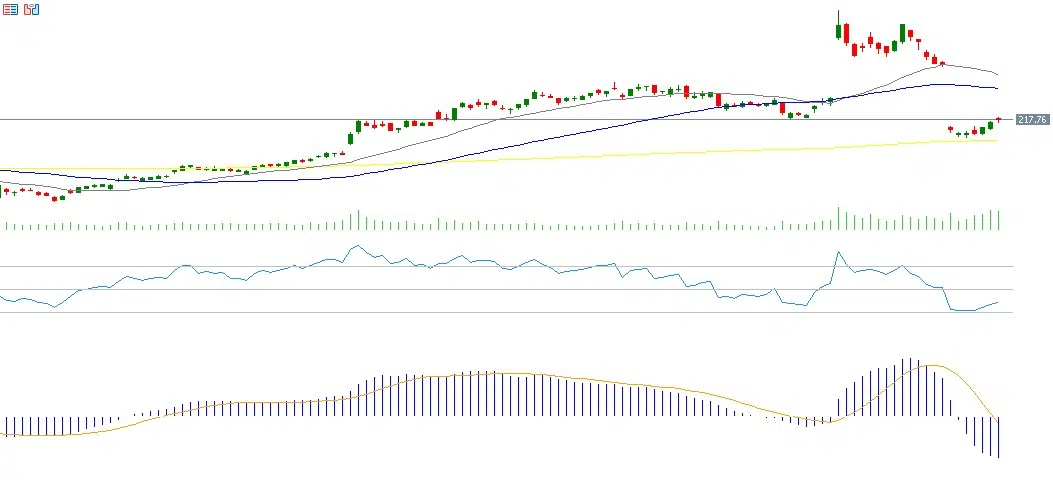

The RSI currently stands at 41, indicating negative momentum, while the MACD shows a bearish crossover between the MACD line (blue) and the signal line (orange), reinforcing the downside momentum.

Oracle

Oracle’s share price has risen approximately 31% year-to-date. Markets are awaiting the company’s third-quarter financial results, scheduled for Wednesday, December 10, 2025. Expectations point to earnings of $1.64 per share, compared to $1.47 previously. Revenues are expected to reach $16.20 billion, up from $14.10 billion in the prior reading.

The RSI is currently at 44, indicating weakening momentum in the stock.

Gold

Gold prices declined by 0.48% last week, closing around $4,200. Despite this minor drop, fundamental and technical indicators continue to support gold in the coming period. The key supportive factors remain:

• A U.S. interest rate-cutting environment, with markets pricing in a 25 bp cut with over 85% probability at the December 10 FOMC meeting.

• Expectations that Kevin Hassett, White House economic advisor, will replace Jerome Powell in May next year—potentially accelerating rate cuts and pushing real interest rates into negative territory.

• Ongoing geopolitical tensions between Russia and Ukraine despite negotiations.

• Rising tensions between the U.S. and Venezuela, including the risk of a U.S. strike inside Venezuelan territory.

• Increasing friction between Japan and China.

• Continued gold purchases by central banks, especially the People’s Bank of China, which has now bought gold for the 13th consecutive month in November.

• Persistent inflation risks, with inflation still near 3%, above the 2% target.

However, caution is warranted ahead of the December 10 FOMC meeting due to a sharp split among committee members over keeping rates unchanged or cutting by 25 or even 50 basis points.

If a 25 bp cut occurs—as most markets expect—focus will turn to the tone of Powell’s address, which might be a hawkish cut, highlighting inflation risks, tariff-driven price pressures, and recommitting to the 2% inflation target.

In this scenario, gold may witness high volatility and could temporarily drop toward $4,000 or $3,900 in the short term.

Over the medium to long term, prices may rise to $4,800 or even $5,000 next year.

The RSI currently stands at 60, indicating continued positive momentum.

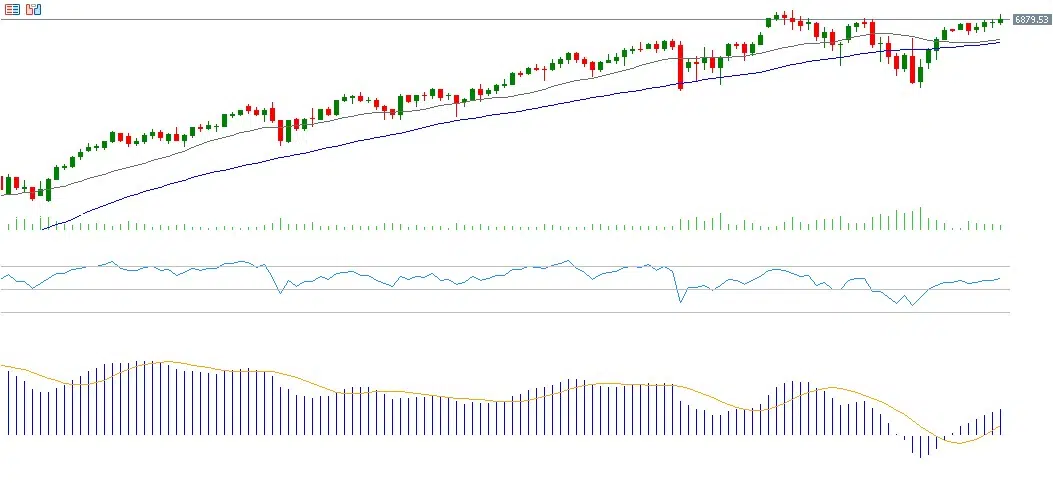

S&P 500

The S&P 500 rose 0.31% last week, closing at 6,870 points. The VIX fell for the fourth consecutive session to 15.28 on Friday—its lowest level since September 18, 2025—indicating strong investor appetite for U.S. equities.

Expectations point toward continued positive momentum despite elevated valuations, supported by:

• Strong Q3 earnings results that exceeded analyst expectations.

• A U.S. rate-cutting environment, with markets pricing in a 25 bp cut at the upcoming FOMC meeting.

• Expectations that Kevin Hassett will replace Jerome Powell, potentially accelerating rate cuts and pushing real interest rates into negative territory—supportive of equity markets.

The RSI currently reads 60, reflecting positive momentum, while the MACD shows a bullish crossover between the MACD line (blue) and the signal line (orange), reinforcing upward momentum.

Key Events This Week

- Monday: Japan’s GDP, U.S. factory orders, and China’s export and import data.

• Tuesday: Reserve Bank of Australia interest rate decision, with expectations of rates remaining at 3.60%. U.K. retail sales data from the British Retail Consortium, and the U.S. JOLTS job openings report.

• Wednesday: Federal Reserve interest rate decision, with expectations of a cut from 4.00%–3.75% to 3.75%–3.50%. Markets will also closely track Jerome Powell’s speech regarding future rate paths.The Fed will also release the Dot Plot, outlining policymakers’ forecasts for rates, inflation, and unemployment.

The Bank of Canada will release its interest rate decision, expected to remain at 2.25%.

China will release CPI and PPI data, along with U.S. crude oil inventory numbers.

• Thursday: Swiss National Bank interest rate decision, expected to remain at 0%. Australia’s employment and unemployment data, and U.S. weekly jobless claims.

• Friday: Japan’s industrial production data, along with U.K. GDP and industrial production.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.