By Camilo Botia

Gold prices plunged below the critical $2,000 per ounce mark, hitting a two-month low on Tuesday, as a hotter-than-expected U.S. inflation report dashed hopes of an early interest rate cut from the Federal Reserve.

The key data point showed U.S. consumer prices rising more than anticipated in January, driven by surging shelter and healthcare costs. This news sent shockwaves through the market, causing a sell-off in gold and bolstering the U.S. dollar.

The report has been perceived as disappointing as investors were hoping for a Fed rate cut in May, with the chances now below 50%.

The rise in inflation raises the prospect of the Fed maintaining its hawkish stance and delaying rate cuts until June or later. Higher interest rates reduce the appeal of holding non-yielding assets like gold, as they increase the opportunity cost compared to interest-bearing alternatives.

The stronger dollar, up 0.7% to a three-month high, weighed on gold’s appeal. A rise in the dollar makes gold more expensive for buyers using other currencies.

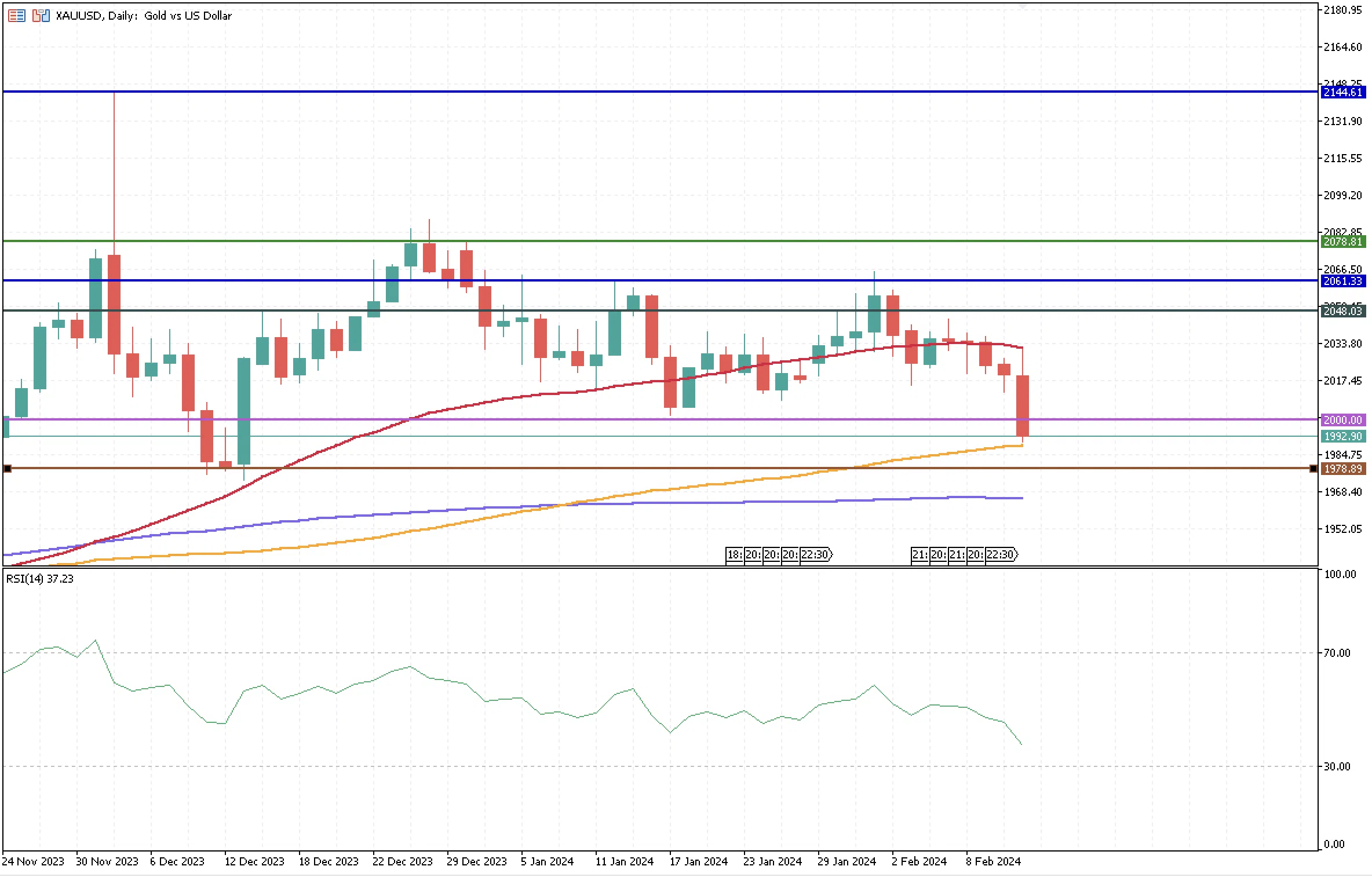

The inflation data pushed down prices sharply lower. Gold is trading below $2,000 with a daily high at its 50-day moving average and a daily low at its 100-day moving averages, which now work as resistance and support levels. Some investors are worried that a drop below $1,950 could trigger a bearish gold market, but to reach this level, gold will have to break two more supports, one at $1,978.00 and below its 200-day moving average at $1,965.47. So far, the market is still not in an oversold condition, as shown by the RSI indicator.

The market’s focus now shifts to Thursday’s retail sales data and Friday’s producer price index (PPI) numbers. Additionally, investors will be monitoring comments from Fed officials this week, who have emphasized the need for further evidence of sustained inflation decline before considering rate cuts.