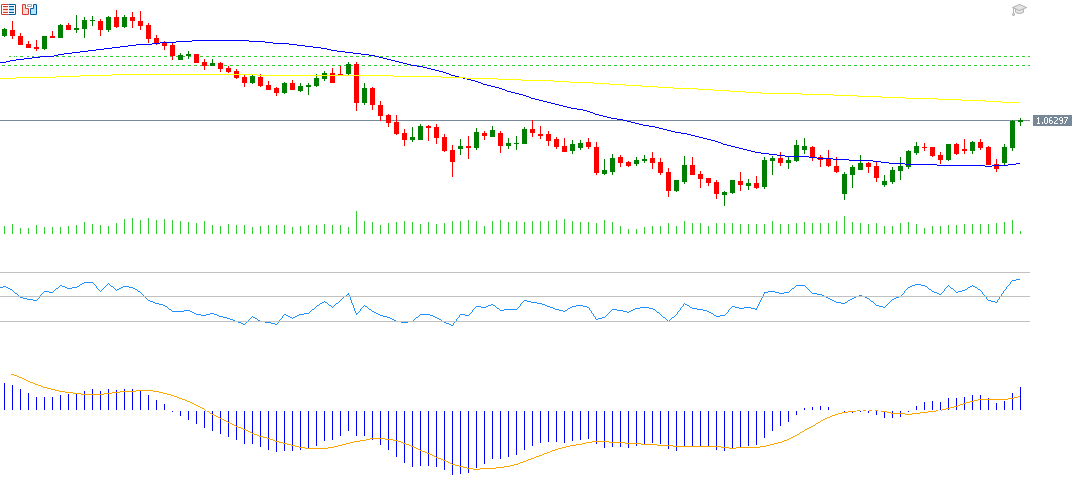

The EUR/USD pair rose to 1.0628 yesterday, marking its highest level since December 6, 2024, after trading in a sideways range between the support level of 1.0200 and the resistance level of 1.0500 over the past three months.

The factors pressuring the euro:

- Expected ECB Rate Cuts:

- The European Central Bank (ECB) is expected to continue cutting interest rates by 25 basis points on Thursday, March 6, 2025, marking the sixth rate cut since it began its accommodative monetary policy in June of last year. Further rate cuts are anticipated, especially as economic data from Germany and France, the two largest economies in Europe, still indicate signs of weakness.

- Additionally, political uncertainties within Europe, particularly the rise of far-right parties, are increasing uncertainty regarding several key economic issues.

- Trade War Threats from Trump’s Administration:

- The U.S. administration has threatened to impose a 25% tariff on imports from Mexico and Canada, along with an additional 10% on Chinese goods, starting March 4, 2025.

- Furthermore, there are threats of 25% tariffs on European products, which could weaken EU exports and put downward pressure on the euro.

The factors supporting the euro:

- Negotiations to End the Russia-Ukraine War:

- If these negotiations succeed in bringing an end to the war, the euro could benefit significantly. Improved supply chains and a potential resumption of trade between Europe and Russia—particularly with cheap Russian gas exports to Germany—could support the euro’s recovery.

- Economic Risks in the United States:

- Several economic indicators suggest growing weakness in the U.S. economy, including:

- A decline in existing, new, and pending home sales

- The largest drop in consumer confidence in four years

- The services PMI contracting to 49.7, its lowest level in two years, signaling an economic slowdown

- Additionally, an inverted yield curve between 3-month and 10-year U.S. Treasury bonds suggests the possibility of an upcoming recession.

- Several economic indicators suggest growing weakness in the U.S. economy, including:

- Mounting U.S. Debt:

- The U.S. national debt has surpassed $36 trillion, with the fiscal deficit continuing to expand. This has prompted Trump’s administration to create a Department of Government Efficiency (DOGE), led by Elon Musk, aimed at combating corruption, waste, and excessive government spending in the coming phase.

Technical Factors:

- A bullish crossover between the MACD indicator (in blue) and the Signal Line (in orange), indicating the continuation of positive momentum for the EUR/USD pair.

- The Relative Strength Index (RSI) currently stands at around 64 points, signaling the continuation of positive momentum for the EUR/USD pair.

Support and Resistance Levels:

- Support: If the pivot point of 1.0574 is broken for the EUR/USD pair, there is a possibility of targeting support levels at 1.0520, 1.0417, and 1.0363.

- Resistance: If the pivot point is surpassed, the pair may target resistance levels at 1.0677, 1.0731, and 1.0834.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.