Last week featured a number of important economic indicators globally. In the U.S., weekly jobless claims fell to 219K, while crude oil inventories rose more than expected by 6.165 million barrels. Factory orders grew by 0.6%, the ISM Manufacturing Index showed contraction at 49.0, and the Manufacturing PMI rose to 50.2. Construction spending increased by 0.7%, job openings fell to 7.568 million, and the private sector added 155K new jobs. The ISM Non-Manufacturing Index dropped to 50.8, while the Services PMI rose to 54.4. The Non-Farm Payrolls report showed 209K new jobs, unemployment ticked up to 4.2%, and annual average hourly earnings growth slowed to 3.8%.

In the Eurozone, the Manufacturing PMI recorded 48.6, headline inflation reached 2.2% YoY, the Services PMI rose to 51.0, and retail sales declined by 0.2%. In the UK, the Manufacturing PMI stood at 44.9 and the Services PMI at 52.5. Switzerland reported a 1.6% YoY rise in retail sales and 0.3% annual inflation. In Canada, the unemployment rate held at 6.7%, while employment declined by 32.6K. The Reserve Bank of Australia kept interest rates unchanged at 4.10%, retail sales contracted by 0.2%, and the Manufacturing and Services PMIs rose to 52.1 and 51.6 respectively.

Japan saw a 2.5% monthly rise in industrial production, a slowdown in retail sales to 1.4% YoY, a Manufacturing PMI of 48.4, a Services PMI of 50.0, and a 3.5% increase in household spending. In China, the official Manufacturing PMI rose to 50.5 and the Non-Manufacturing PMI to 50.8. Caixin Manufacturing and Services PMIs posted growth at 51.2 and 51.9 respectively.

Market Analysis

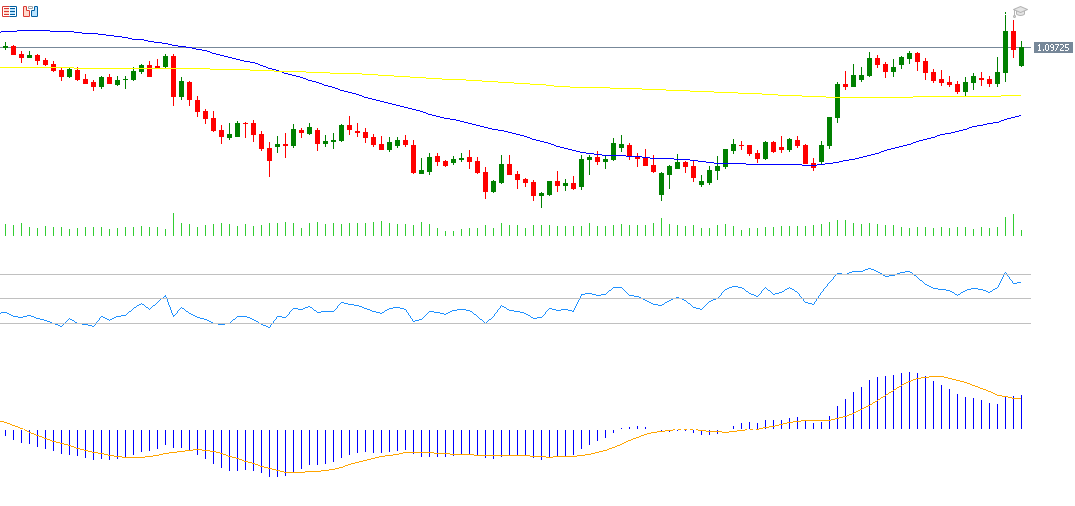

EUR/USD

The euro has risen approximately 6% against the U.S. dollar year-to-date. The pair reached a high of 1.1146 on Thursday, April 3, its highest level since September 30, 2024, and is currently trading near 1.0950. The pair is experiencing high volatility due to trade tensions involving the Trump administration. The RSI currently stands at 63, indicating bullish momentum for the euro.

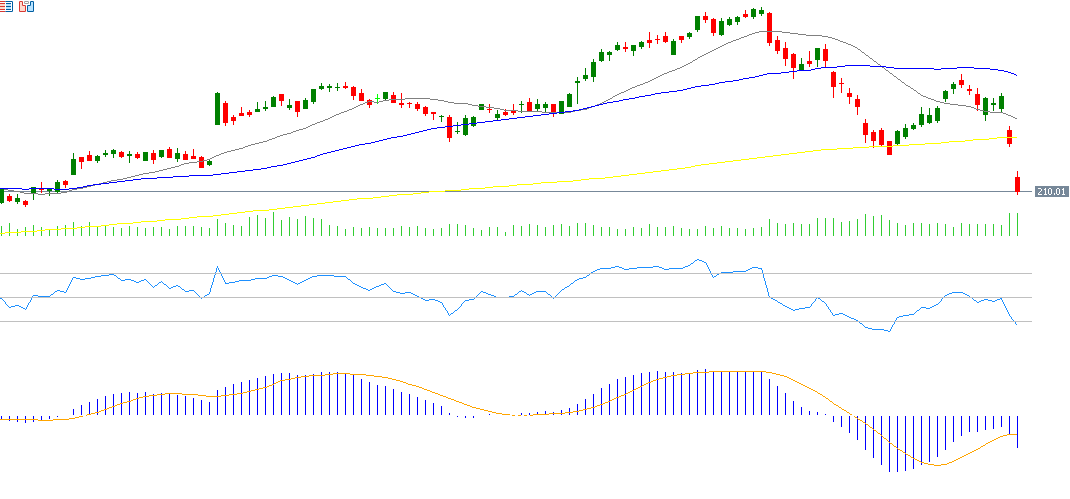

JP Morgan Chase

JP Morgan Chase shares have declined by around 12% year-to-date. Markets are awaiting the bank’s Q1 2025 earnings on Friday, April 11, with expectations of $4.55 EPS, down from $4.63 previously. Revenues are forecast at $43.11 billion, up from $42.50 billion. The RSI is currently at 26, indicating oversold conditions and bearish momentum.

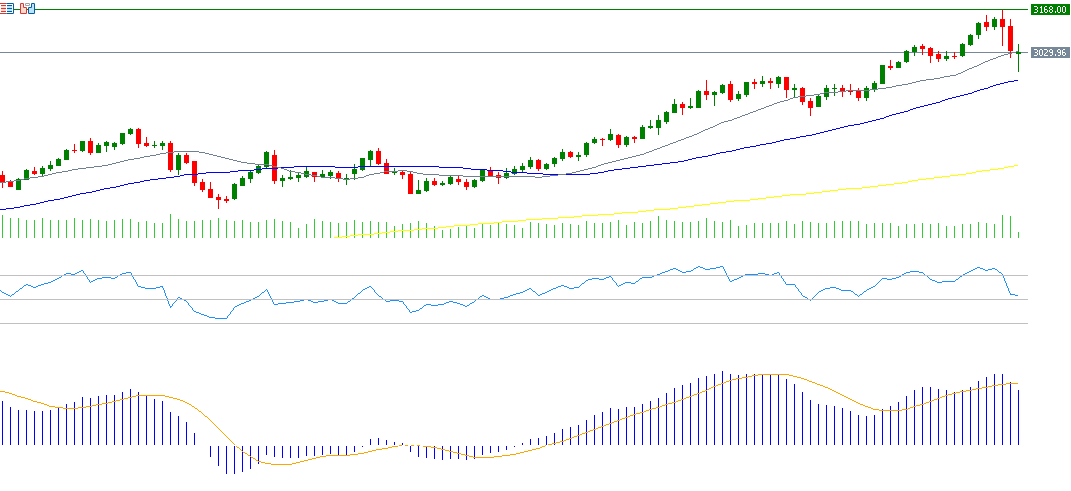

Gold

Gold prices reached a new all-time high of $3,168 on Thursday, April 3, 2025, driven by global trade tensions, central bank gold purchases, and expectations of three Fed rate cuts this year. The RSI is at 54, reflecting upward momentum in gold prices.

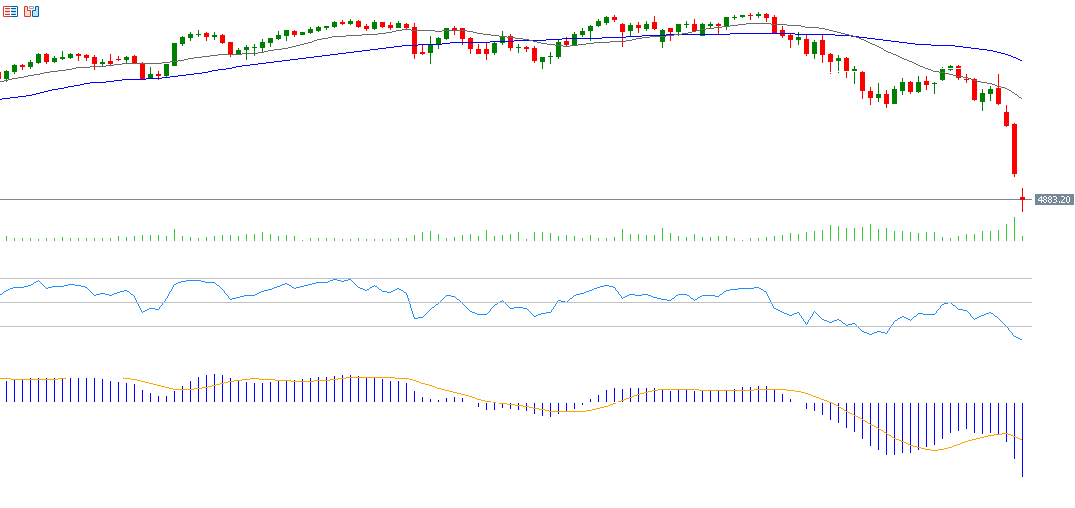

S&P 500

The S&P 500 closed at 5,074 on Friday, April 4, its lowest level since May 2, 2024, and is down approximately 17% from its peak of 6,147 on February 19, 2025. Year-to-date, the index is down around 14%. This significant drop is attributed to ongoing trade disputes and recession fears in the U.S. The RSI currently reads 23, placing it in oversold territory with bearish momentum. The MACD also shows a bearish crossover, as the blue MACD line has crossed below the orange signal line.

Key Events This Week

- Tuesday: Markets await the release of the Ivey PMI in Canada.

- Wednesday: Focus is on the Reserve Bank of New Zealand’s interest rate decision, with expectations of a 25-basis point cut from 3.75% to 3.50%. The FOMC meeting minutes and U.S. crude oil inventories are also scheduled.

- Thursday: China will release CPI and PPI data, while the U.S. will publish CPI and weekly jobless claims.

- Friday: The UK will release GDP figures, and the U.S. will report PPI and the University of Michigan Consumer Sentiment Index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.