Last week witnessed several significant global economic developments. In the United States, data showed a noticeable slowdown in inflationary pressures, with both the headline and core Consumer Price Index (CPI) declining, along with a drop in the Producer Price Index (PPI). This reinforces expectations of potential monetary policy easing in the near future, despite a slight increase in unemployment claims and a decline in consumer confidence. In the United Kingdom, data was positive, with strong growth in both GDP and industrial production, indicating a relative improvement in economic performance. In Canada, the Ivey PMI fell, reflecting a slowdown in business activity. The Reserve Bank of New Zealand made a move to cut interest rates to stimulate the economy. Meanwhile, China continues to face deflationary pressures, with declines in both consumer and producer price indices, raising concerns about weak domestic demand and a slowing recovery.

Market Analysis

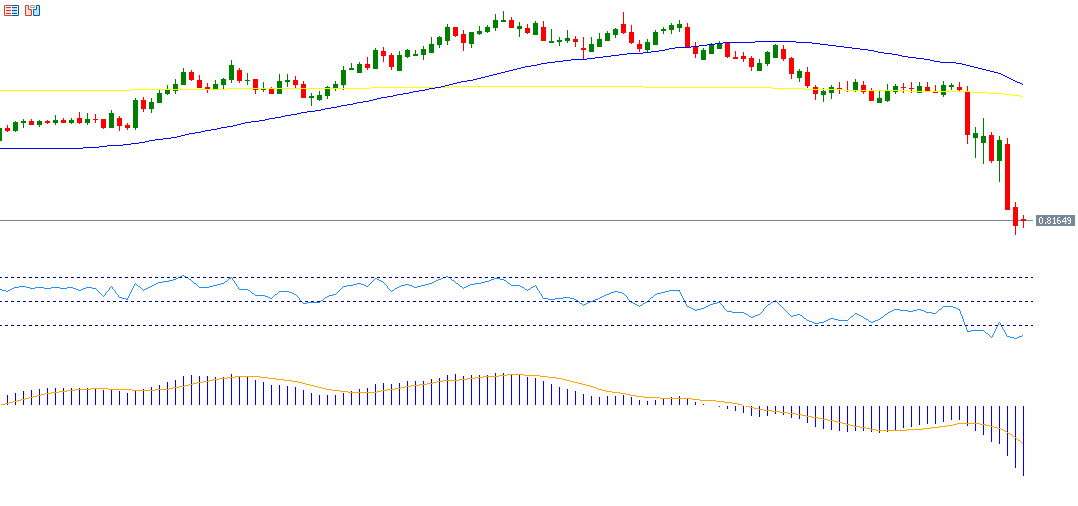

USD/CHF

The USD/CHF pair recorded a level of 0.8098 on Friday, April 11, marking its lowest level in 14 years. The pair has declined by about 10% year-to-date. The strength of the Swiss Franc is largely attributed to its status as a safe-haven currency during times of uncertainty, especially amid ongoing trade tensions between the U.S. and China. The Relative Strength Index (RSI) stands at 18, indicating the pair is in oversold territory, reflecting strong bearish momentum.

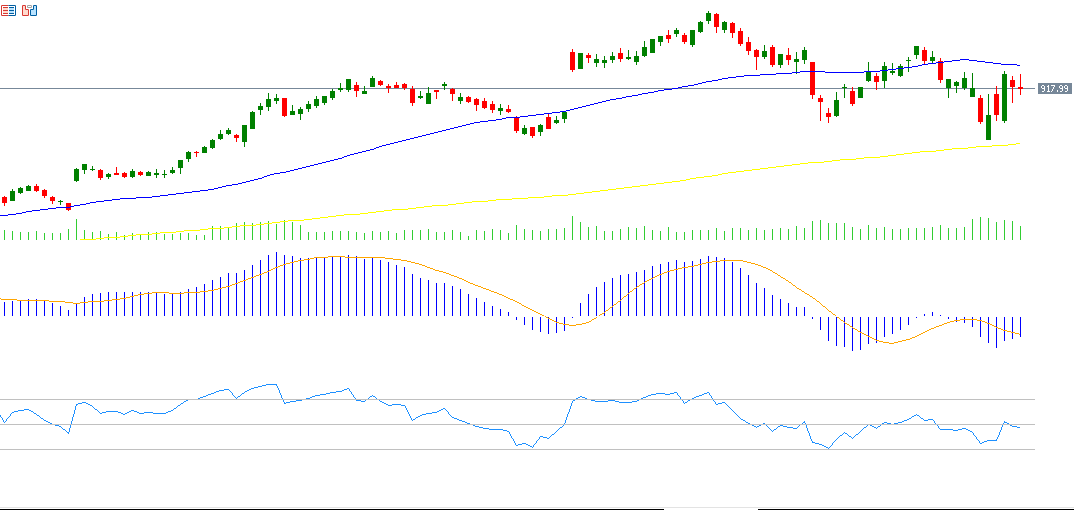

Netflix

Netflix stock has risen approximately 3% year-to-date. The market is closely watching for the company’s Q1 earnings report, with expectations of earnings per share reaching $5.76, up from the previous $5.28. Revenue is projected at $10.51 billion, compared to $9.37 billion previously. The RSI is currently at 48, signaling moderate bearish momentum.

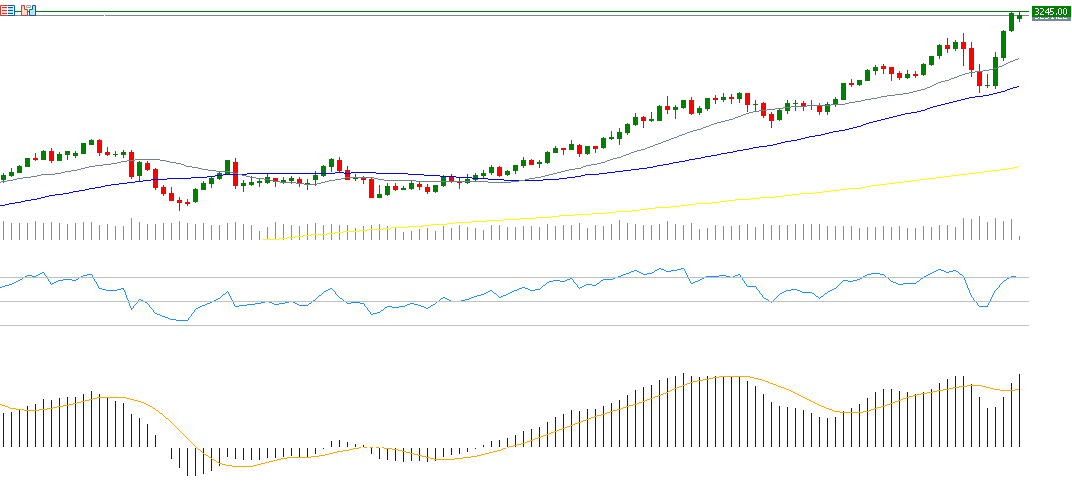

Gold

Gold prices surged to an all-time high of $3,245 on Friday, April 11, 2025, driven by escalating trade tensions between the U.S. and China, expectations of a potential rate cut by the U.S. Federal Reserve, continued geopolitical tensions in the Middle East, and sustained gold purchases by central banks globally. The RSI stands at 71, indicating overbought conditions and strong bullish momentum. The MACD shows a bullish crossover, with the MACD line (blue) crossing above the signal line (orange), reinforcing a positive outlook for gold.

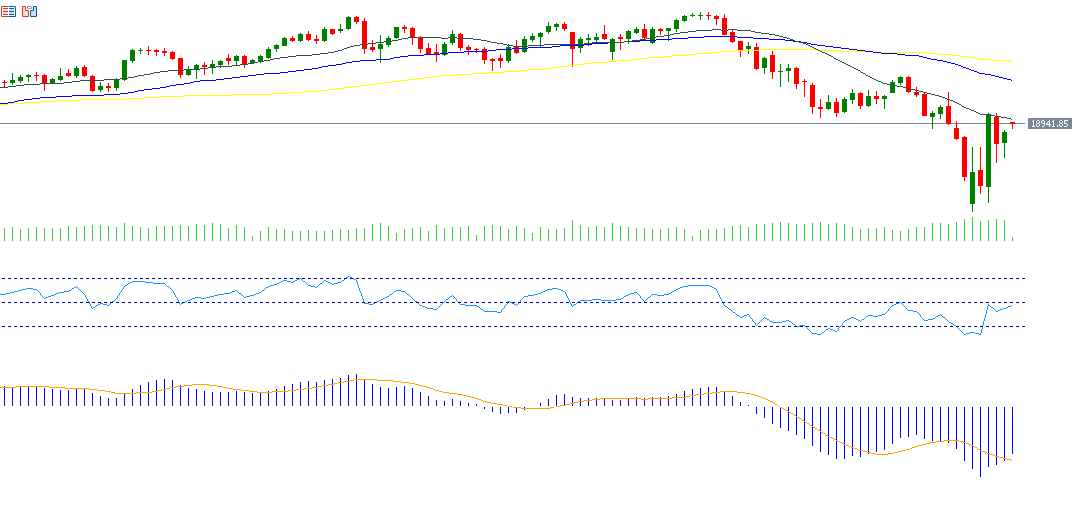

Nasdaq 100

The Nasdaq 100 index rose about 7% over the past week, though it remains down approximately 11% year-to-date. Volatility is expected to continue in the coming period due to the ongoing trade war between the U.S. and China. Markets are also anticipating Q1 earnings results from major tech companies, with expectations that many will beat analysts’ estimates. However, investor focus will likely shift toward forward guidance from company executives. The RSI is at 45, indicating slight bearish momentum for the index.

Key Economic Events This Week

Markets are anticipating several important economic indicators and data releases this week, which are expected to influence global market movements:

- Monday: Japan will release its Industrial Production Index, while China will publish both Export and Import figures.

- Tuesday: The U.K. will release data on average earnings including bonuses and the unemployment rate. Meanwhile, the Eurozone will publish industrial production data, the Empire State Manufacturing Index will be released in New York, and Canada will report its Consumer Price Index (CPI).

- Wednesday: The Bank of Canada is set to announce its interest rate decision, with expectations of keeping rates steady at 2.75%. In China, multiple data points will be released including GDP, industrial production, retail sales, unemployment rate, and fixed asset investment. Additionally, CPI data from the Eurozone and the U.K. will be published, along with U.S. retail sales, industrial production, and crude oil inventories.

- Thursday: Markets will focus on the European Central Bank’s interest rate decision, with expectations of a 25-basis point rate cut. Also due are New Zealand’s CPI, Japan’s trade data, and Australia’s employment and unemployment figures. In the U.S., data on jobless claims, the Philadelphia Manufacturing Index, and building permits will be released.

- Friday: The week ends with the release of Japan’s Consumer Price Index.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.