Choosing a forex broker can feel like a significant decision for any trader. It can shape your fees, the safety of your funds, and your overall trading experience. Whether you are just starting out or already have some trading experience, the right choice may save you money and unnecessary hassle. There are also less obvious differences between brokers, so careful research can help reduce future frustration.

Picking a broker works like opening a door to the forex world. A decent broker might give you tools, some resources, and basic help to trade.

With thousands of options available, you’ll need to consider cost, regulation, and platform ease.

This guide highlights the key factors to consider when choosing a forex broker that aligns with your trading goals.

What is a Forex Broker?

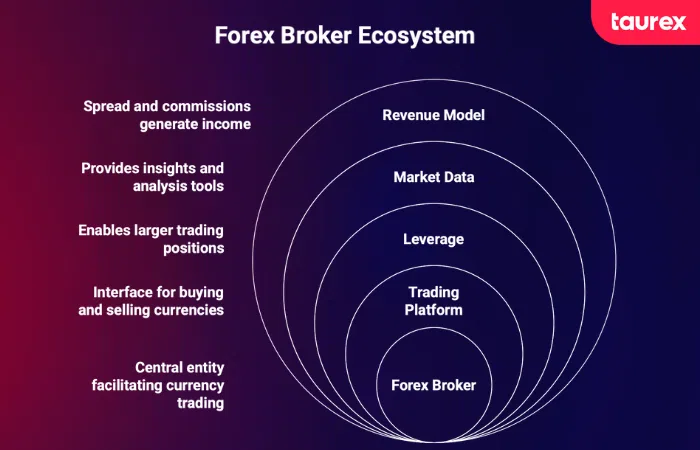

A forex broker is a company that gives you access to trade foreign currencies. Because the forex market is not centralised, you cannot simply join it on your own. The broker connects you to the interbank market, where real currency exchanges take place, making it easier for you to start trading.

Forex brokers provide a trading platform where you can buy and sell currency pairs.

- Brokers also allow leverage so that a trader can control a bigger position with cash.

- Orders are carried out by brokers in the market, and they supply market data, charts, and analysis tools.

- Most of the money a broker earns comes from the spread —the gap between buy and sell prices —as well as from commissions on trades.

- Some also charge overnight financing when a position is held more than one day.

Knowing how a broker earns money may affect the costs you face, so it’s wise to compare a few before choosing one.

Qualities of a Good Forex Broker

Regulation and Safety of Funds

Before picking a forex broker, consider looking at the regulations. A regulated broker is supervised by a financial authority, which supports transparency and helps protect clients from certain types of misconduct.

Key regulatory bodies to look for include:

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Services Authority (FSA) of Seychelles

Taurex is proudly regulated by the Seychelles Financial Services Authority, the FCA in the UK, and the SCA (Category 5 licence). This framework reflects our commitment to meeting global standards, maintaining clear oversight, and supporting a secure trading environment for our clients. This oversight drives us to deliver industry-leading practices, pure consistency, and nothing but the best for you.

Beyond regulation, verify that the broker:

- Keeps client funds in segregated accounts separate from company operational funds

- Offers some form of negative balance protection

- Provides clear information about their regulatory status and license numbers

Many traders overlook fund protection, often assuming their platform has it covered. At Taurex, client security comes first. Eligible clients may benefit from insurance coverage of up to USD 1 million, adding an additional layer of protection.

Spreads, Costs, and Commissions

Trading costs can significantly impact your overall results and cost of trading; therefore, understanding a broker’s fees is crucial, although many additional factors often come into play.

Spreads are the gap between a currency’s bid and ask, usually noted in pips; they may be fixed or floating.

- Fixed: Remain constant regardless of market conditions

- Variable: Fluctuates based on market liquidity and volatility

Commissions: Brokers might take a flat charge for each trade or a small percentage of the deal.

Account Types: Different account types come with different cost structures. At Taurex, for example, the Standard Zero account has no commission, though spreads may be slightly wider. For more active traders, the Pro Zero account offers tighter spreads with a commission-based model. This way, traders can choose the option that best fits their trading style.

Hidden Fees: Watch out for additional charges, such as:

- Deposit and withdrawal fees

- Inactivity fees

- Overnight financing (swap rates)

We keep our fees simple, so you always know what you are paying when you trade with us. Our Raw accounts, for example, combine ultra-tight spreads with a small commission. They are an excellent choice for high-frequency traders who want to keep costs low while making fast moves, but they also work well for any trader who values transparent pricing and tighter spreads.

Variety of Markets to Trade

Sure, you might be diving into forex trading right now, but having the option to explore other markets can really help mix things up! It’s a great way to diversify your portfolio and find trading opportunities, no matter what’s going on in the forex market.

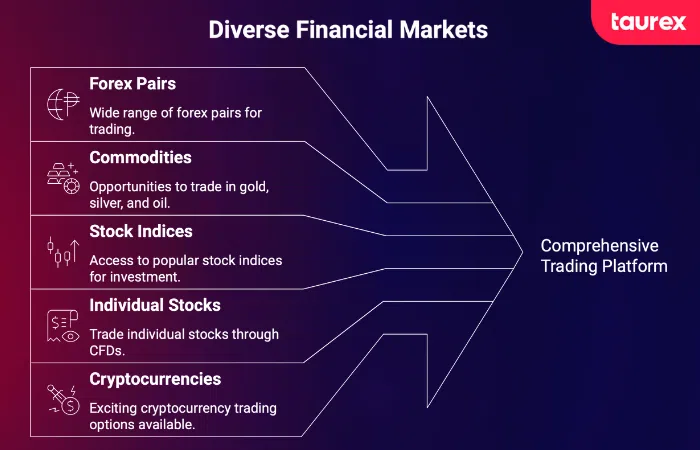

A good broker should give you access to:

- Major, minor, and exotic forex pairs

- Commodities like gold, silver, and oil

- Popular stock indices

- Individual stocks

- Cryptocurrencies for those interested in digital assets.

Taurex gives you access to over 1,500 trading instruments across various asset classes, making it easier to diversify your portfolio without juggling multiple trading accounts. This wide range proves particularly useful as you grow as a trader and want to try out new strategies in different market conditions.

Execution Speed and Slippage

Fast and reliable execution is very important, especially if you’re into short-term trading strategies. Slippage, which is when the price you expect for a trade doesn’t quite match the price it actually executes at, can really eat into your gains, so it’s something to watch out for!

Factors that can impact how smoothly your trades are executed include:

- The kind of tech the broker is working with

- How close are their servers to big-time liquidity providers

- The way they handle and route your orders

- How stable and reliable their connection is

Taurex utilises the most advanced technology to match you with multiple liquidity providers, ensuring you receive great prices and fast execution. Our systems are optimised to minimise delays, giving you the speed and reliability you need—especially during high-volatility moments when every millisecond counts.

For traders who rely on automated strategies or scalping techniques, the quality of execution can significantly impact their experience. Taurex places a strong emphasis on its execution technology, making its platform a great fit for all kinds of trading styles, whether you’re into day trading or prefer holding onto positions for a bit longer.

Leverage and Margin

Leverage is like getting a little extra muscle for your trades: you can control a big position even if you’ve only got a small amount of cash. But heads up, while it can boost your profits, it can also ramp up your losses.

When you’re checking out a broker’s leverage options, here are a few things to keep in mind:

- The maximum leverage they offer for various instruments.

- How much margin do you need to open and maintain a position

- How their margin call process works (you’ll want to know how they alert you if your balance gets low).

- Their stop-out levels: basically, when they’ll automatically close your trades if you don’t have enough margin.

Simple enough, right?

Leverage limits can vary, depending on where your broker is regulated. Like, in some areas, brokers might cap leverage at 30:1 for major currency pairs, and it could be even lower for other trading instruments.

Ready to take your trading to the next level? Let’s do it, because we’ve got everything you need! Our platform provides dynamic leverage tailored to your account size, along with all your favourite assets to trade.

And there’s more! There’s an excellent built-in risk management system with margin calls and stop-out rules to contain your losses. It’s like having your own personal safety net as you go for your trading ambitions! By balancing big opportunities with smart responsibility, you’ll trade with total confidence and unbeatable peace of mind. Let’s make it happen!

Trading Platforms and Tools

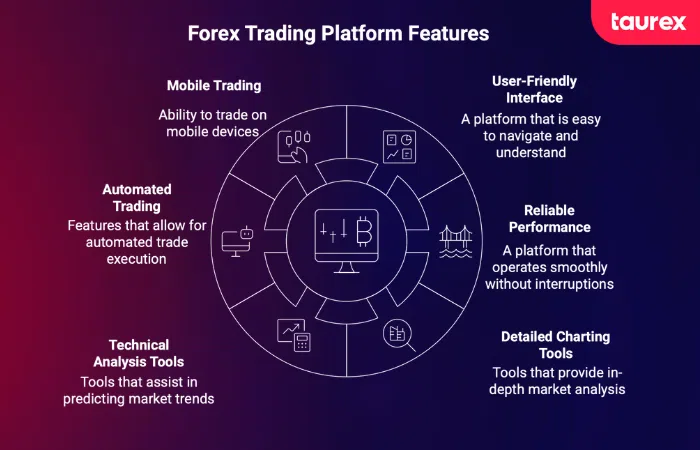

The platform should feel like your desk, looking simple, staying steady, and holding the charts you rely on. Brokers could provide their own software or offer MT4 or MT5 as standard trading options.

Here are some key features to keep an eye out for when picking a forex trading platform:

- An easy-to-use interface

- Reliable performance that won’t let you down

- Detailed charting tools to help you stay on top of things

- Handy technical analysis tools

- Options for automated trading to save you time

- Mobile trading features so you can trade on the go

Taurex has got you covered with both MetaTrader 4 and MetaTrader 5: two top-notch trading platforms that traders love for their reliability and great features. MT4 is user-friendly and perfect if you’re into automated trading, while MT5 kicks it up a notch with more timeframes, extra order types, and powerful analytical tools.

And, there’s more! Taurex also offers its own excellent mobile application for iOS and Android, allowing you to track markets and make trades from anywhere. The app has everything you need, including live prices, easy chart analysis, and account management. It’s an excellent option for anyone who would like to trade from anywhere, unencumbered!

Customer Support and Availability

Even the most experienced traders need assistance from time to time. While instant help can’t always be guaranteed, responsive and knowledgeable customer support can make a significant difference — helping you resolve issues quickly, avoid potential losses, and seize trading opportunities.

When evaluating a broker’s customer support, consider the following:

- Support hours – Ideally, they should align with forex market hours and be available 24/5.

- Contact options – Multiple channels, such as phone, email, and live chat, offer greater flexibility.

- Language support – Assistance should be available in a language you’re comfortable with.

- Response times – The faster the support team responds, the smoother your trading experience.

- Expertise – Knowledgeable representatives who can resolve issues efficiently are essential.

We’re here to help with our dedicated, multilingual customer support, available 24/5. Whether you have technical questions, account-related concerns, or need guidance on trading features, our team is here to help through multiple channels.

Reliable support is especially crucial during periods of market volatility or if you encounter platform issues. In those moments, having an experienced and responsive team by your side can make your trading journey significantly smoother and far less stressful.

Risk Management and Educational Resources

A strong forex broker does more than provide access to the markets — they also empower you to become a more informed and confident trader. High-quality educational resources and risk management tools are key to building your skills and protecting your capital over the long term.

Look for Forex brokers that offer:

- Webinars and video lessons

- Easy-to-follow trading guides and articles

- Insights through market analysis and research

- Demo accounts to practice and get the hang of things

When it comes to managing risks, you’ll want to make sure your broker offers tools like:

- Stop-loss and take-profit orders

- Guaranteed stops (though these might come with some extra fees)

- Risk calculators

- Position sizing tools

At Taurex, we’re committed to helping you trade with confidence by making sure you feel informed every step of the way. Our Education Portal is designed as a comprehensive learning hub. Whether you’re starting from the basics or refining advanced strategies, you’ll find beginner-friendly guides, in-depth articles, and regular market reports to help you navigate the trading landscape with clarity.

We also make risk management straightforward with built-in platform tools that let you set stop-loss and take-profit levels, giving you more control over your trades. And if you’re not ready to trade live just yet, our demo account offers a safe space to practice strategies and explore the platform without risking any capital. It’s all part of our mission to help you grow your skills and trade smarter.

Account Types and Features

Most brokers offer a range of account types to match different trading styles and capital levels. Understanding the differences can make it much easier to choose the one that suits your goals.

Here are some key features to compare when evaluating account options:

- Minimum deposit required

- Spreads and commissions

- Available leverage options

- Additional perks or benefits

- Special account types, such as Islamic accounts compliant with Sharia law

At Taurex, we offer a variety of accounts tailored to different trader profiles.

- Standard Zero – A straightforward, commission-free option ideal for beginners.

- Pro Zero – Designed for active traders who want tighter spreads.

- Raw – Built for experienced traders focused on premium execution quality.

We also provide Islamic accounts that operate without swap rates, making them suitable for traders who follow Islamic finance principles.

And to help you build skills and confidence, every trader gets unlimited access to our demo accounts. It’s a risk-free environment where you can practice strategies, test the platform, and explore all its features without spending any real money.

How to Find A Good Broker: A Step-by-Step Guide

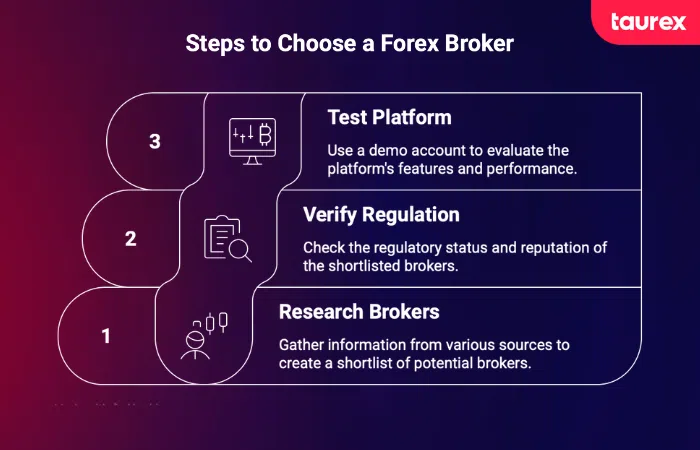

As a new trader, you’ll inevitably find yourself asking, “How do I choose the right forex broker?” It’s a key decision that can significantly impact your trading journey. Finding a suitable broker can be overwhelming, especially if you’re new to trading. You’ll want to sort through the opinions and data before deciding.

Research and Compare Brokers

- Make a short list using:

- Recommendations from other traders

- Industry reviews and ratings

- Comparison websites

- Forum threads and community chatter

- Build a spreadsheet that tracks:

- Regulation status

- Trading costs like spreads or commissions

- Which instruments are offered

- Platform choices

- Minimum deposit needed

- What real customers say

Doing this can help you resist the pull of flashy ads. This method may feel slow at first, but the clearer picture saves time later. Remember, no single ranking tells the whole story. Take time, it pays off.

And yet even with all that data, you might still feel uneasy when the perfect broker feels just out of reach.

Verify Regulation and Reputation

Once you’ve narrowed down your list of potential brokers, it’s essential to take a closer look at their regulatory standing and track record. This step protects you from unnecessary risks and ensures you’re trading with a trustworthy partner.

Here’s how to check a broker’s regulatory background:

- Visit the broker’s website and locate the regulation or licensing section.

- Verify the license number directly on the regulator’s official site.

- Check for any warnings, fines, or disciplinary actions issued against the broker.

- Review the company’s history and financial stability to understand how established and reliable it is.

A broker’s reputation among traders also provides valuable insight. Instead of focusing on individual negative reviews, look for overall patterns in feedback to get a clearer picture of the company’s credibility and performance. Learn the red flags that signal fraudulent operations in our “Is Forex Legit?” guide, protecting yourself starts with knowing what to avoid.

At Taurex, we simplify this process by prominently displaying our regulatory information on our homepage, including our license details and the governing authority. This level of transparency reflects our commitment to compliance, client protection, and industry best practices.

Test the Platform with a Demo Account

Before committing real funds, consider starting with a demo account. It allows you to explore the platform’s features and ensure everything runs smoothly, without any financial risk. You can practice placing different order types, such as market and limit orders, and experiment with charting tools to see which indicators best support your trading style. It’s also an opportunity to test the responsiveness of customer support and evaluate the overall user experience — all before trading with real money.

During demo testing, pay close attention to a few key factors:

- Platform stability and speed — These often reflect how the platform will perform under real market conditions.

- Navigation and usability — Switching between tabs and features should feel intuitive and seamless.

- Chart quality and analysis tools — Ensure they are accurate, responsive, and align with your trading approach.

- Order execution behavior — Check whether demo orders mirror real market conditions, as this can indicate how live trades will function.

Evaluating these elements helps you assess the platform’s reliability and suitability before you trade with real funds.

Taurex’s demo mirrors the live environment closely. However, a demo might run slower than actual trading due to server load so that results could differ. That means you can use every function, but without risking money. This hands‑on trial often decides if the broker fits your trading style.

Conclusion

Selecting a forex broker is not a decision to make lightly. Your priority should always be regulation and security, as an unlicensed broker can put your funds at risk.

Next, consider costs such as spreads, commissions, and any potential hidden fees that could impact your profitability over time. The trading platform should be both intuitive and easy to navigate, while also offering the essential tools you need — from fast-loading charts to reliable order execution. And when issues arise, responsive customer support can make all the difference.

Your trading style also shapes what matters most. Day traders often prioritise ultra-tight spreads and lightning-fast execution, while part-time traders may value a more straightforward interface and access to educational resources.

Using a structured checklist can help you evaluate brokers more objectively, but remember that no method eliminates risk. Ultimately, the right broker is the one that aligns with your trading goals, strategy, and comfort level.

FAQs

What is the best forex broker for new traders?

Finding a good broker for a new trader involves considering a few key factors.

First, there should be strong lessons and a demo account to practice.

Second, the platform should be easy to use and not confusing.

Third, help lines need to answer quickly; otherwise, frustration builds.

Fourth, the start‑up money shouldn’t be huge; a few hundred dollars can work.

Fifth, fees must be transparent and low.

One example is Taurex, which offers tutorials for beginners and mid-level users today. We keep things simple, rather than overwhelming you with technical screens.

Can I trade forex with just $100?

Many brokers accept deposits of $100 or even less. Yet trading with such a tiny account may mean you have to watch risk closely. You need reasonable risk control, proper position size, and you should keep expectations about profit realistic. Also, you need to understand how leverage works and the dangers it poses.

Taurex is great for traders of all budget sizes, offering accounts with low minimum deposits. That said, having a little extra capital can make things easier, providing more flexibility and helping you avoid feeling pressured to take risky moves.

How do I know if my forex broker is regulated?

First, you go to the broker’s site and look for a regulation page. There should be licence numbers shown; sometimes they’re hidden behind footers.

Second, you could check the regulator’s website and type the broker’s name into their register. The name listed may differ from the brand you see in ads.

Third, ensure the license is valid for your country of residence; otherwise, it may not provide protection.

Real brokers such as Taurex tend to put this data front and centre, and the numbers can be checked elsewhere.

If nothing appears, that could be a warning.

What are the common mistakes to avoid when choosing a forex broker?

It’s easy for beginners to get lured in by flashy bonuses, but these offers can come with hidden risks.

Some traders prioritise high leverage over ensuring the broker is properly licensed, which can have negative consequences later. Skipping the fine print about withdrawals is another common mistake that often leads to frustration down the road.

Many people also dive in with real money before trying a demo account, only to discover unexpected platform quirks.

While choosing the cheapest broker may seem appealing, factors such as fast order execution and dependable customer support are often far more critical.

Instead of getting swept up by big promises or slick marketing, look for brokers with transparent rules, responsive support, and a proven track record that fits your trading approach.

Make sure you know your own risk tolerance before committing funds.