By Camilo Botia,

Bitcoin and the broader cryptocurrency market are facing a significant downturn, raising concerns about the sustainability of the recent rally. The price of Bitcoin has fallen by over 17% since its mid-March peak, wiping out hundreds of billions of dollars from the total market capitalization of digital assets.

Several factors are contributing to the decline, including slowing inflows into US Bitcoin exchange-traded funds (ETFs) and the prospect of higher interest rates from the Federal Reserve.

• Waning ETF Enthusiasm: The initial launch of US Bitcoin ETFs in January fueled a surge in Bitcoin’s price, but the momentum appears to be fading. Analysts point to the recent outflows from these ETFs as evidence that some investors are losing confidence in the short-term prospects of cryptocurrencies.

• Interest Rate Jitters: The prospect of higher interest rates from the Federal Reserve also dampens investor sentiment in the crypto market. Higher interest rates typically make riskier assets like Bitcoin less attractive.

• Failed Hong Kong Boost: Last week’s debut of Hong Kong crypto ETFs was unable to brighten the mood, suggesting that even broader adoption of cryptocurrencies may not be enough to reverse the current downtrend.

While the recent price decline is concerning, it’s important to note that not everyone is bearish on Bitcoin’s long-term outlook. Some analysts maintain a positive stance, believing that the current pullback is a healthy correction and that Bitcoin has the potential to reach new highs by the end of the year.

The derivatives market also suggests investors anticipate a period of lower volatility for Bitcoin, with key volatility indexes dropping to two-month lows. This could indicate that investors believe the recent price swings are temporary and that the market may stabilize.

The immediate future of the cryptocurrency market remains uncertain. However, this recent downturn serves as a stark reminder of the inherent risks associated with digital assets. It’s crucial for investors to carefully consider their risk tolerance before making any decisions regarding cryptocurrencies.

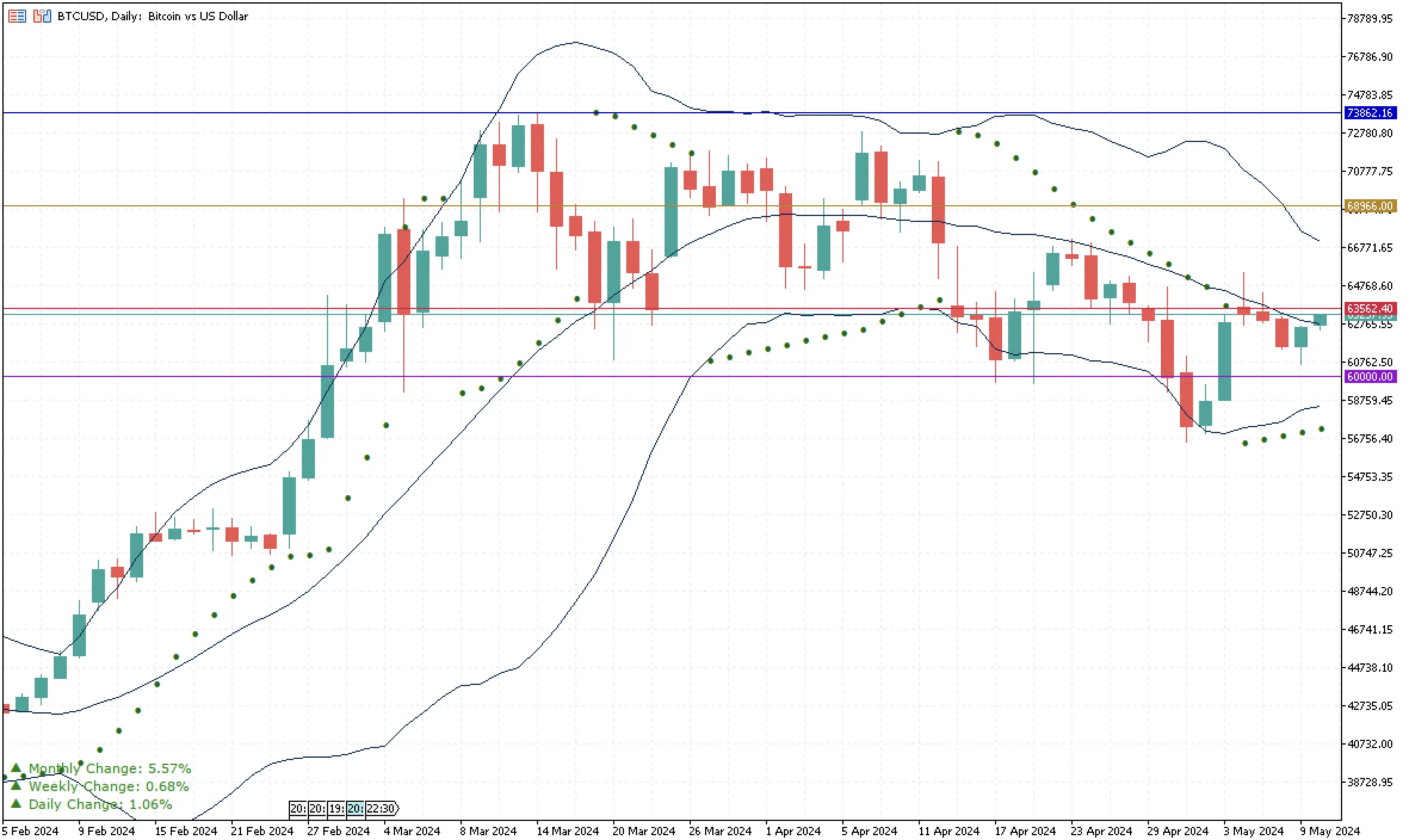

Bitcoin remains below 63,562.40, a significant weekly level for the price, and the 20-day moving average has consistently limited Bitcoin from reaching higher highs since mid-April. The Bollinger Bands show that volatility has decreased in the last week on Bitcoin, with the closest support remaining at 60,000 as the most significant floor for the price in the short term.