Last week witnessed a series of important economic events around the world. In the United States, the number of unemployment claims dropped to 213,000, while the Services PMI rose to 57.0 points, marking the highest level since March 2022. However, the Philadelphia Manufacturing Index declined, and existing home sales showed a slight increase. In the Eurozone, the Consumer Price Index (CPI) remained stable at 2.0%, while the Services PMI contracted to its lowest level since January 2024. In the UK, consumer prices rose more than expected, but retail sales declined. Canada saw an increase in the Consumer Price Index, while Japan’s CPI showed a slight rise. In China, the People’s Bank of China decided to keep lending rates unchanged.

Market Analysis

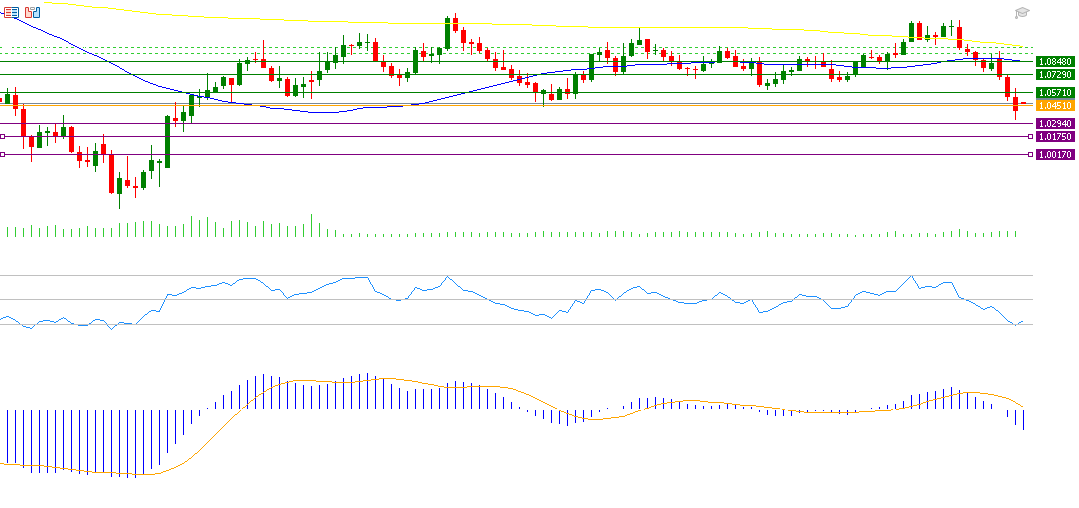

EUR/USD

The EUR/USD exchange rate reached 1.0331 on Friday, November 22, its lowest level since November 30, 2022. It has declined by approximately 8% from its peak of 1.1214 on September 25, 2024, to its low on November 22 at 1.0331. It has also fallen by about 6% year-to-date. The negative momentum for the EUR/USD pair seems to dominate in the upcoming period due to several factors, notably the continued weakness of economic data in the Eurozone and the strength of the US dollar. If the pivot point of 1.0451 is broken, the pair may target support levels at 1.0294, 1.0175, and 1.0017. On the other hand, if the pivot point is exceeded, resistance levels of 1.0571, 1.0729, and 1.0848 may be targeted.

Dell Technologies

Dell Technologies’ stock has risen by about 91% since the beginning of the year. The company is expected to announce its financial results on Tuesday, November 26. It is expected to report earnings of $2.07 per share, lower than the previous reading of $1.88. Revenues are expected to reach $24.69 billion, compared to $22.30 billion previously.

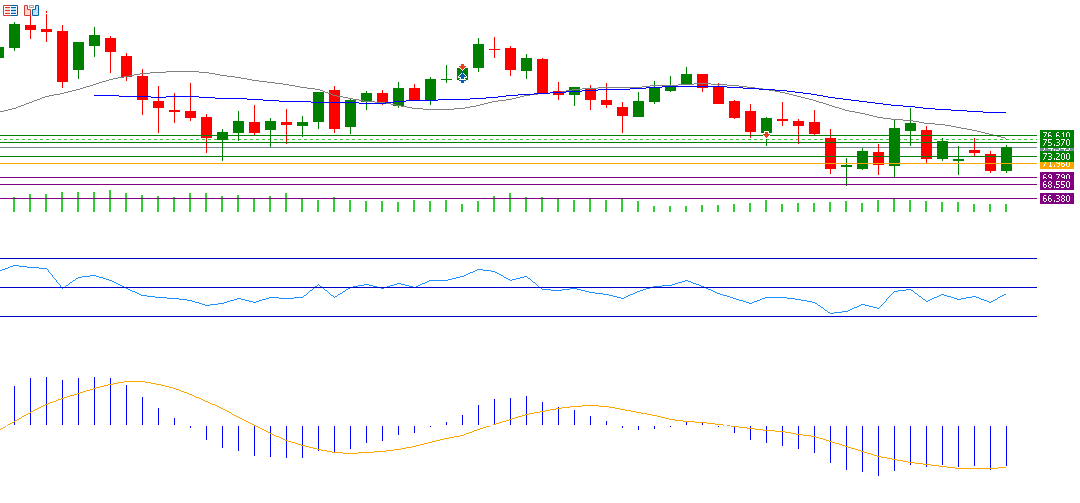

Crude Oil

Crude oil prices rose last week from $70.74 to $75.05, an increase of about 6%. This rise is attributed to the escalating geopolitical tensions between Russia and Ukraine, as well as continued tensions in the Middle East. If the pivot point of $71.96 is broken, crude oil may target support levels at $69.79, $68.55, and $66.38. However, if the pivot point is exceeded, resistance levels of $73.20, $75.37, and $76.61 may be targeted.

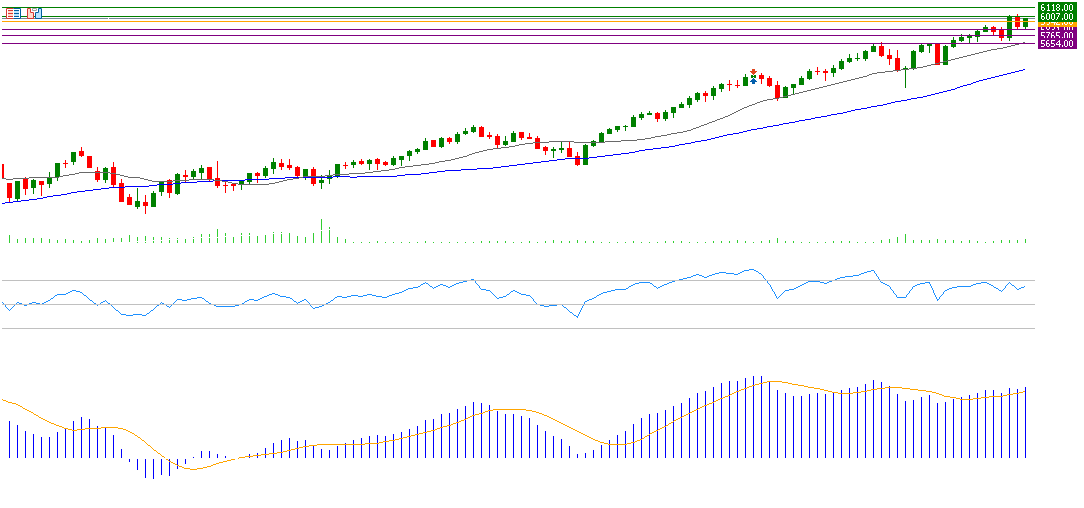

S&P 500

The S&P 500 index has risen by about 26% since the beginning of the year, reaching 5,969 points on Friday, November 22. This surge is largely due to Donald Trump’s ascension to the presidency, which provided positive momentum for US stocks, particularly with his pledge to lower corporate tax rates and reduce market expectations regarding the pace of future interest rate cuts. If the pivot point at 5,942 is broken, the index may target support levels at 5,831, 5,765, and 5,654. If the pivot point is exceeded, resistance levels at 6,007, 6,118, and 6,184 may be targeted.

Key Events This Week

Markets are awaiting several important economic indicators and data releases this week:

• Today, New Zealand’s Retail Sales Index will be released.

• On Tuesday, markets will be focused on the US Consumer Confidence Index, New Home Sales, and the Federal Open Market Committee (FOMC) meeting minutes.

• On Wednesday, the Reserve Bank of New Zealand’s interest rate decision is expected, with a forecasted 50 basis point cut from 4.75% to 4.25%. Additionally, data on Core Durable Goods Orders, GDP, Unemployment Claims, Core Personal Consumption Expenditures (PCE) Prices, Pending Home Sales, and US Crude Oil Inventories will be released.

• On Thursday, the Eurozone Consumer Confidence Index will be issued.

• On Friday, Japan’s Consumer Price Index for Tokyo, Industrial Production, Retail Sales, Unemployment Rate, and Switzerland’s GDP will be announced.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.