Last week, several important economic developments occurred across major economies. In the United States, unemployment claims dropped to 221,000, which was lower than expected, but the unemployment rate increased to 4.1%, higher than both expectations and the previous reading. Oil inventories saw a significant rise of 3.614 million barrels. Other economic indicators showed improvements in areas such as the manufacturing PMI, while the non-farm employment index declined. In the Eurozone, the European Central Bank cut interest rates by 0.25%, and inflation data showed higher-than-expected growth, while retail sales were below expectations. In the UK, manufacturing and construction PMIs showed a decline, while the services sector continued to grow. In Canada, employment data showed a significant decline, while the unemployment rate remained stable. In Australia, the economy saw growth in GDP, but the services PMI showed a decline. Meanwhile, in China, both manufacturing and services PMIs showed growth, but exports and imports decreased significantly. Additionally, the Consumer Price Index (CPI) fell by 0.7% year-on-year, while the Producer Price Index (PPI) showed a contraction of 2.2% year-on-year.

Market Analysis

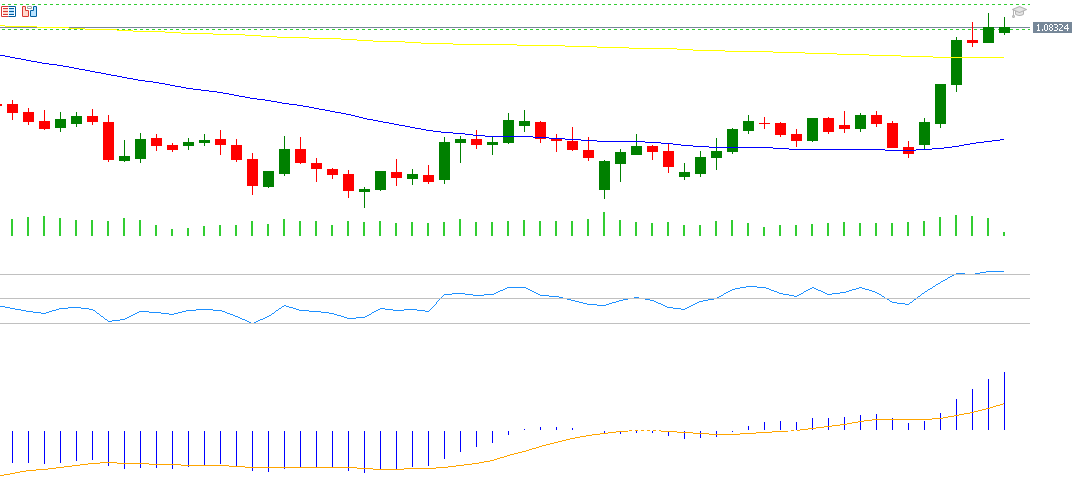

EUR/USD

The euro against the US dollar rose to 1.0889 on Friday, March 7, 2025, marking the highest level since November 6, 2024. This notable rise is attributed to several factors, most notably the European Union’s plan to increase military spending by $840 billion, following U.S. President Donald Trump’s decision to withdraw support for his allies, particularly in regard to defense spending. Additionally, recent improvements in some European economic data have supported the euro, while U.S. economic indicators, particularly in the labor market, have shown a slowdown, which further supports the euro. The Relative Strength Index (RSI) is currently at 73, indicating an overbought condition, reflecting positive momentum. Meanwhile, the MACD shows a bullish crossover between the MACD line and the Signal Line, suggesting that the upward trend for the EUR/USD pair is likely to continue.

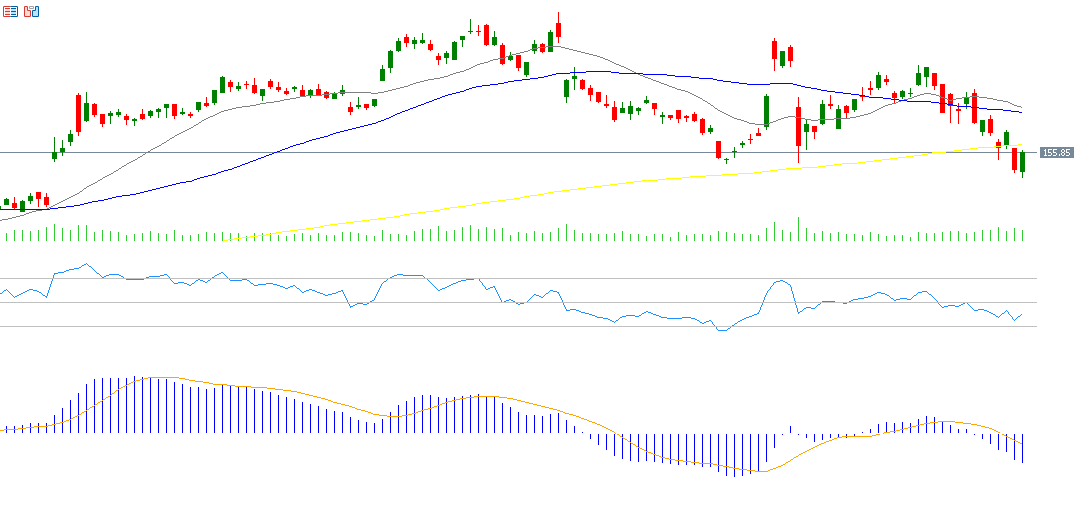

Oracle

Oracle’s stock has declined by about 7% since the beginning of the year. The markets are awaiting the company’s financial results today, with expectations for earnings of $1.49 per share, up from $1.41 in the previous reading. As for revenue, the markets are expecting it to reach $14.39 billion, up from $13.30 billion in the previous reading. The RSI currently stands at 40, indicating negative momentum for Oracle’s stock.

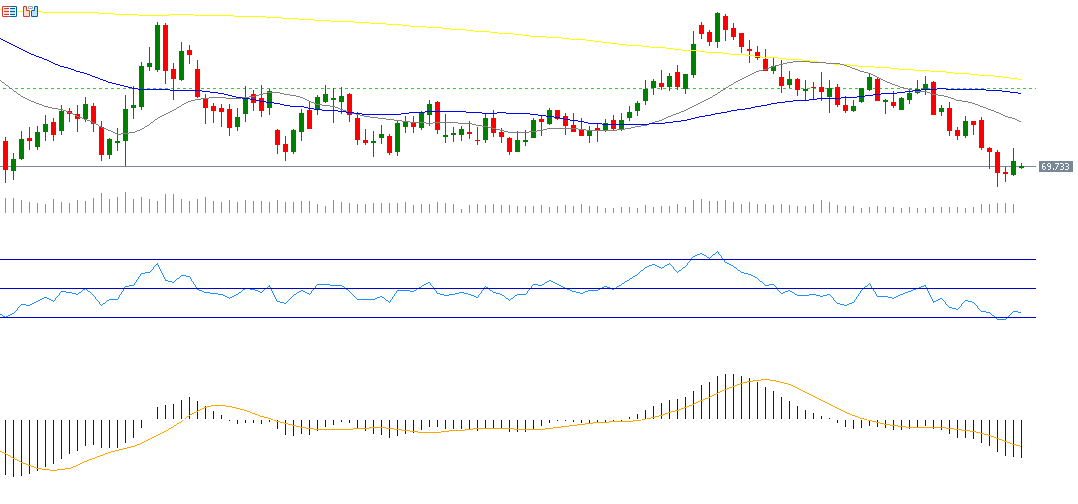

Crude Oil

Crude oil prices dropped to $68.37 on Wednesday, March 5, 2025, the lowest level since December 2021, and are currently trading near $70. This decline is due to several factors: an increase in market supply, concerns about a potential economic recession in the United States, a gradual oil production increase by OPEC+ starting in April, and the tariffs imposed by Trump on certain countries. The RSI currently stands at 36, indicating bearish momentum for oil. The MACD shows a bearish crossover between the MACD line (blue) and the Signal Line (orange), signaling negative momentum for oil.

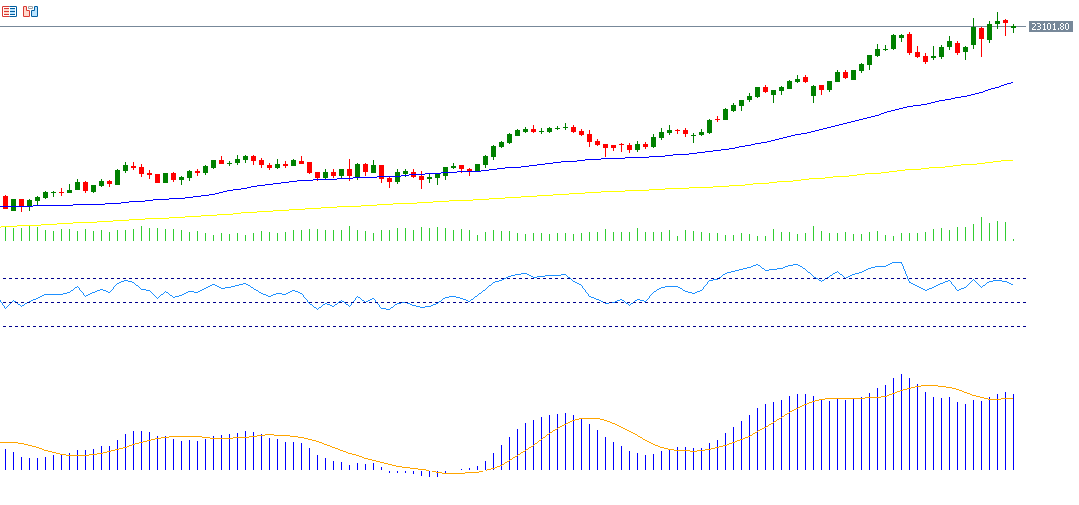

DAX Index

The German DAX index continues to hit record levels, reaching 23,476 points on Thursday, March 6, its highest level ever. It has risen by about 16% since the beginning of the year, outperforming the French CAC40 index (10%), the UK’s FTSE 100 index (7%), and the European STOXX600 index (9%). It has even outperformed U.S. stock indices such as the S&P 500 (-2%) and Nasdaq 100 (-4%). The RSI currently stands at 59, indicating positive momentum for the DAX.

Key Events of This Week

Markets are awaiting a number of important indicators and economic data this week:

• On Tuesday, the markets will be looking out for the Household Spending and GDP indicators in Japan, as well as the Job Openings data in the United States.

• On Wednesday, the markets are waiting for the interest rate decision from the Bank of Canada, with expectations for a 25 basis point rate cut from 3.00% to 2.75%. The U.S. Consumer Price Index (CPI) and U.S. crude oil inventories will also be released.

• On Thursday, the markets are focusing on the Industrial Production Index in the Eurozone, along with the Producer Price Index (PPI) and Weekly Jobless Claims data in the United States.

• Finally, on Friday, the markets will be looking for the GDP and Industrial Production data from the UK, the New Loans data from China, and the University of Michigan Consumer Sentiment Index in the U.S.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.