Silver continues its upward trend, having reached $39.13 yesterday — the highest level since September 22, 2011. The main challenge ahead lies in breaking through the key psychological resistance level at $40.00. Currently, the price is trading near $38.50.

Silver has surged by approximately 38% from its low of $28.36 recorded on April 7, 2025, to the recent peak. Since the beginning of the year, silver has gained around 33%, outperforming high-risk assets such as Bitcoin and global equity indices — particularly those in the U.S., Europe, China, and Japan. Silver has even outperformed gold, which has risen by 28% year-to-date. Market expectations point to a continuation of silver’s bullish trend.

Key Drivers Behind Silver’s Rally:

Several factors are currently supporting the rise in silver prices, including:

- Strong industrial demand for silver, which is used in a wide range of industries, including pharmaceuticals, medical supplies, and electronics.

- Rising gold prices, with gold reaching $3,375 yesterday — its highest level in three weeks.

- Market expectations that the U.S. Federal Reserve will cut interest rates twice this year, which is supportive of silver as a non-yielding asset.

Focus on Upcoming U.S. Inflation Data:

Markets are closely watching today’s release at 4:30 PM UAE time of the U.S. Consumer Price Index (CPI) and Core CPI (which excludes food and energy).

- The headline CPI is expected to rise by 2.6% year-over-year in June, compared to 2.4% in May.

- The Core CPI is projected to increase to 3.00% year-over-year in June, up from 2.8% in May.

As such, caution is advised — any reading below expectations for either indicator could have a positive impact on silver prices.

Technical Analysis of Silver:

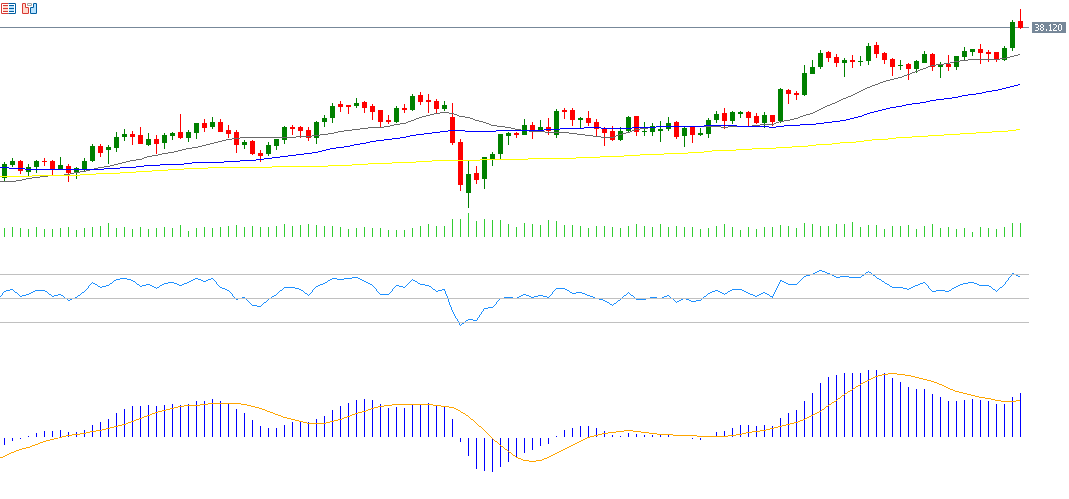

The prevailing trend for silver appears to be bullish, supported by the following technical indicators:

- A positive alignment of the 20-day, 50-day, and 200-day moving averages, with the 20-day above the 50-day, and the 50-day above the 200-day.

- The Relative Strength Index (RSI) is currently at 68, indicating continued bullish momentum.

- The MACD is showing convergence between the MACD line (blue) and the signal line (orange); any bullish crossover would further reinforce the positive outlook for silver.

Please note that this analysis is provided for informational purposes only and should not be considered as investment advice. All trading involves risk.